Another Motley Fool growth stock to sniff out for you today …

David Gardner has gotten a reputation as a compelling “rule breaking” growth stock picker over the past few decades, with some huge winners chosen (and held through very tumultuous times) as he built the Motley Fool with his brother Tom.

The flagship Motley Fool Stock Advisor newsletter has gotten more and more inexpensive over the years as they’ve cut the price to bring in more readers and get them into the “upgrade cycle” for their more expensive services, but the performance of that letter has still been good on average (beating the broad market quite handily over the last decade) as it features the ongoing battle between value-focused Tom and growth-focused Dave.

Now, that doesn’t mean David Gardner picks only great-performing stocks — like most growth investors, his portfolio is presumably very patchy, with substantial losers mixed in with the 1,000% winners — but it does mean that we stand up and pay attention when he starts teasing a new stock … partly because we’re curious about what  it might be, and partly because the marketing prowess of the Motley Fool means we’re going to get lots of questions from our readers whenever they come out with a new pitch.

it might be, and partly because the marketing prowess of the Motley Fool means we’re going to get lots of questions from our readers whenever they come out with a new pitch.

So what’s today’s spiel? Well, as with a lot of the recent Fool ad letters it’s not actually signed by David Gardner, the ad comes from Fool analyst Lyons George, and here’s how he gets us interested:

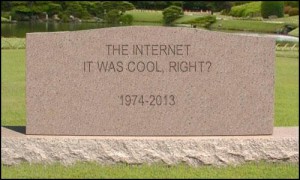

“They’ll Call 2014 the Year the Internet Died… But You’ll Just Call It ‘The Year I Made My Millions’

“Silicon Valley is dancing on the Internet’s grave — and gearing up to cash in on the birth of an even BIGGER market.

“From solving traffic jams to weighing soup cans…

“From catching terrorists to watching television …

“From modern medicine to professional football…

“And dollar for dollar, insiders are calling for the biggest new market in the history of capitalism…”

He goes on with some thinly veiled cites of commentary by John Chambers (referred to just as “John”) about revamping Cisco to help grow with “the mystery market bigger than the Chinese economy” that’s projected to become a $14.4 Trillion market … so of course we’re curious. $14.4 Trillion is big (and yes, it is more than the current annual GDP of China).

The $14.4 Trillion number they’re throwing around as an estimate is for the year 2020 (the number was dramatically lower recently, $44 billion for 2011, the ad says), so it’s crazy growth but it’s within the somewhat foreseeable future, and that’s the target time period for this stock as well — apparently David Gardner thinks this one can make you a return of 89X your money on this pick, turning your $500 investment into $44,500.

So what’s this secret market? More from the ad:

“4 Words, 1 Can’t-Miss Opportunity… Get in NOW on ‘The Internet of Everything’ …

“When it comes to investing in game-changing new technologies, history has proven time and again that the real money isn’t in the invention of something…

“The real money is in the implementation….

“Why NOW is the final stage of the Digital Era’s ‘Implementation Gap’

“Put simply, the Internet of Everything is the final stage of the Internet’s progression….

“The Internet — and all the potential for progress it brings with it — is about to move from “Internet-Only” objects to EVERYDAY objects…

“Meaning tens of billions of regular ‘things’…

“Sidewalks and cereal boxes…minivans and dress pants…the lawn mower in your shed and the pillows on your bed…

“Will soon be connected together in an Internet of Everything….

“The Death of the ‘Internet’ — and the birth of the ‘InterWorld'”

OK, so it’s the “Internet of Everything” or the “Internet of Things” that we’ve been hearing about for a decade now — is it really going to happen? The promise has been the refrigerator that knows when you’re out of milk and orders it for you, the car that sends your husband a message when you’re running late, smart clothes that know when they’re dirty or when your heartbeat is erratic, etc., the sensors and controllers everywhere that interact with the digital world. And lots of it is possible now and has been possible for a while, depending on how much you want to spend, though integration into the consumer economy might be coming at unpredictable speeds.

"reveal" emails? If not,

just click here...

[My favorite product that fixes a problem I’ve never had? the $70 egg tray that tracks which eggs are oldest and should be used first and syncs with an app on your phone. An app. For deciding which egg to use and telling you when you’re running low. I’m lucky if I remember to take them out of the carton and put them in the tray in the first place, I’m certainly not going to sync the egg tray with my phone. But you get the idea — sensors and wireless stuff is now cheap enough that someone green-lighted this project, and people are buying it.]

And, as you might have guessed by now, we’re told that there’s “one small company” at the heart of this that will make us rich, with 89% annualized gains over the next six years:

“… regardless of how you feel about the revolutionary technological shift the InterWorld represents, the facts of the matter are painfully clear:

- The InterWorld revolution is already underway — and gaining momentum at an incredible pace.

- There is exactly one company that sits at the very heart of the InterWorld market…and it stands to rake in hundreds of billions of dollars between now and 2020.

“Most investors haven’t heard about the InterWorld yet — they’re still busy trying to figure out when Apple will release another piece of ‘iJunk’.

“But those savvy individuals who HAVE clued into this opportunity are going all-or-nothing into the ONE small-cap company that stands to grow in lockstep with the InterWorld market.”

So yes, finally we get to the hints and teasers about this little stock … or, as we like to call ’em here, “clues”:

“In a small town just North of Seattle, one company isn’t just ‘riding’ the InterWorld wave…

“With every product it ships out the door, it’s making the wave happen.

“Its technology is the final piece of the InterWorld puzzle — much like the internal combustion engine completed the auto industry, and the cathode-ray tube made it possible to put a television in every living room in America.

“Its customers include everyone from city planners to video-game designers… from auto manufacturers to fire departments… from a tiny coffee-machine company all the way up to General Electric and Chrysler Motors.

“It is the definitive leader in its space…

“With a dominant market share and over 350 issued patents…

“In short, it’s a no-brainer for anyone who wants direct exposure to the InterWorld market’s +8,937% growth in the coming years.”

And we’re also told that this stock has already gained 127% this year, so there’s another clue (David Gardner always says he doesn’t really start to like a company until Wall Street is screaming about how “overvalued” it is).

A few other clues roll across the transom, too, including that RBC Capital reiterated it at “overweight” on October 9, and that Royce just upped its holdings to 1.1 million shares, and the Swiss National Bank just started buying.

That’s probably enough to feed into the gaping maw of the Mighty, Mighty Thinkolator and get our answer — but first, let’s just share a little bit of the spiel from the Fool about what this company sells and does:

“… the physical objects that will make up this ‘huge brain’ need to be outfitted with devices that allow them to ‘talk’ about what’s happening…

“That’s where ’embedded wireless modules’ — the flagship product of this exceptional little company — come into play.

“Like the copper wiring that enabled a once-fledgling technology known as “electricity” to cover the globe, wireless modules are at the very center of the InterWorld’s explosive growth trajectory.

“WIRLESS MODULES: The ‘Copper Wiring’ of the InterWorld Era …

“… within every wireless module that this company sells lies the power for it to analyze what’s happening to the object it’s embedded in, and then transmit that data back to the appropriate destination.

“And considering that experts are projecting the number of wirelessly embedded devices to balloon from 1.5 billion to 50 billion by 2020, it’s a safe bet that the demand for these modules is going to be massive for years to come.”

Then we have one final bit that caught my eye in the ad:

“The company I’m writing you about today is that rarest of finds…

“An experienced player, in a niche space set for extreme growth, with an absolute stranglehold over its market.

“As I already mentioned, the fact that this company is the hands-down leader in its space with over 350 issued patents already has some forward-thinking investors (and Wall Street sharks) on the move…

“After all, it’s not every day you see a business with a ‘competitive moat’ that wide!

“But here’s the real icing: even though the InterWorld market is just now taking off, this company has been perfecting this technology for over 16 years…

“Meaning it has all its ducks in a row to fully exploit a once-in-a-century hyper-growth business environment while its competitors are still wondering who turned the lights on! …

“Realistically speaking, if you have a few thousand dollars of dry powder lying around…

“This will most likely be the last stock you — and your family — will ever need….”

Any financial advisor will probably tell you that there is no such thing as “the last stock you will ever need,” and that this kind of thinking is dangerous to your financial health … but still, as every financial copywriter knows, hope springs eternal. We all want those 8,000% gains to make us more comfortable in our golden years (or to make it so we can afford to buy $70 egg trays without blinking an eye).

So after all that, what is our “secret” stock? Secret no more, this is: Sierra Wireless (SWIR)

Sierra Wireless is a small Canadian tech company (yes it’s in a “small town North of Seattle” — Richmond, British Columbia), and they have indeed been on a tear this year, getting up to $20 a share for the first time since the financial crisis (they’ve dipped down a bit recently, shares now just under $18 as I type). They have a market cap of about $500 million, so quite tiny, and they’re expensive based on either trailing or forecasted earnings but do also have a large cash pile of about $6 a share (and no debt).

If you account for the cash, you can say that the shares trade at a forward PE of only about 24 (50 cents in earnings in 2014 expected), which sounds a bit more reasonable than the numbers look at first blush, but it’s still expensive — particularly because analysts are baking in pretty low growth expectations for the future. So it looks like David Gardner is making a big picture argument that SWIR is going to see much higher demand for its products in the coming years, with good revenue and earnings growth, and the Wall Street (OK, Bay Street) analysts are forecasting something a lot more tepid.

Sierra Wireless is going “all in” with this “Internet of Things” with the sale this year of their AirCard business (that’s their mobile broadband product) to NetGear, and that sale resulted in what looks like a huge earnings number this year (that’s why the trailing PE looks amazingly low — most of that $2+ in trailing earnings isn’t operating earnings). That basically allows SWIR to put the full force of the company behind their “machine to machine” products, referred to as M2M, that are a key enabler of this network of intelligent devices. Here’s how they put it in the press release about the sale a few months ago:

“This transaction is the next step in our transformation into a company focused on enabling the ‘Internet of Things’ – a strategy we have been pursuing with great success since 2007,” said Jason Cohenour, President and CEO of Sierra Wireless. “We are the world leader in this dynamic market, with the industry’s broadest product lineup, solutions across the value chain and an extensive, blue-chip customer base. In addition to realizing a solid return for the AirCard business, this transaction will provide significant financial resources and capacity to accelerate our growth in M2M and connected device solutions.”

So … that’s a large part of why the shares have doubled this year — optimism about that “internet of things” and their leadership of the M2M market and ability to get out of the AirCard business with a profit. Analysts haven’t allowed their expectations to boom along with the stock, but clearly David Gardner is all over it as a long term play — so really, your quick reaction to this stock will probably come down to whether you agree with Gardner about the huge growth potential of the “InterWorld” or agree with the analysts in their skepticism about the next year’s earnings. Or you could find both arguments compelling, of course, and think that SWIR will enable amazing things in the future but might be too expensive today.

Me? I dunno. It’s hard to think they could fall more than 50% from here, given their huge cash pile, but I also don’t know much about the business yet or where most of their revenues come from, and I don’t know about any potential competition. I’ve seen estimates that they hold about a third of the market for M2M modules and they have a lot of “blue chip” clients in electronics and automotive and other sectors, but that leaves two thirds of the market to … who? I dunno. I also don’t know anything about their patent position, other than the fact that they do say they have more than 350 patents.

To me it looks like it’s worth researching, but all I’ve done so far is confirm that this is certainly the stock they’re pitching and take my quick gander at their books. What do you think? Let us know with a comment below.

Oh, and a quick P.S. — this is an excerpt from that latest reiterated buy recommendation by RBC’s analyst when they raised the price target to $20 … this came out on October 9, when the stock was between $17.50-$18, just like it is today:

“M2M Comes into Vogue: Raising Target

“We are reiterating our Outperform recommendation and raising our price target on Sierra Wireless from $16 to $20. Investor enthusiasm for M2M and the Internet of Things has raised the valuation multiple on Sierra Wireless and its peers. We see more room for upside and believe Sierra’s leadership warrants a multiple towards the mid-point of M2M peers.”

Cool Report, will check you out more than MF!

After carefully reviewing as much of the publicly available information that I could find the conclusion that I arrived at is everyone has been completely and utterly blinded to the reality of the fact that without “The Internet” the world will simply cease to exist as we know it. The “InterWorld” is just a marketing hype to get the cash flowing necessary to finance the manufacturing and marketing campaigns needed to bring the “Internet of Things” to the masses that will be connected to the newly created and updated bio-metrically authenticated “Trusted Platform Managed” devices that everyone will come into contact with as they go through their daily routines. Oh and did I mention all of this begins and ends with massive amounts of data mining going on every second of every day being sold to the companies with the deepest pockets to insure that they can target their key demographic markets and sell them their next great product before the costumer even is aware he/she needs it. Think quantum computing on a global scale all of the “internet of things” devices will be interconnected and could/can possibly communicate via qbit OTA pipelines allowing for answers to questions we mere humans ask being answered before we have even asked them simply because of the sheer volume of available processors linked in parallel around the globe online running 24/7/365 . The long and short of it here are my recommendations for stocks to watch buy/hold then in 6 years sit back cash out and start your own MF newsletter because you were smart enough to realize its all about the marketing hype and as PT Barnum said, “There’s a sucker born every minute.” ADBE , AMD , BAYRY , DTV , LNVGY , TMUS , and finally SWIR. Now out of that list of stocks the average 1 year return to date has been 38% approx. Rule of 72 says my money is going to double every 2 years at that rate of return. If I were to remove even just one stock from that list because it is the only single digit return stock listed AMD with a 8.4% return over the last year. My average only jumps up to 43% but my money doubles every 18/19 months. Thing is why would I take out one of the biggest chip manufactures on the planet for computing tech right when they are poised to bust out a single computer on a chip solution that will in fact make all of this technology a reality for the “Internet of Things connected via the InterWorld” M2M communications that will drive the global economy towards a global credit system that will be used to insure that we all pay are fair share of the life debt that is created out of the chaos that this entire global economy altering system will have for every single human being on this planet that is not living under a rock somewhere. So that’s my 2 cents worth invest, don’t invest your choice in the end you won’t be able to take any of the worthless paper with you when you are going to which ever version of the afterlife you happen to choose to believe or not believe in. Live Long and Prosper seems to be the appropriate way to end this. Thank you SGP for such a interesting and worthwhile forum to gain edification from after having been properly fleeced of my valuable time by reading/listening to MF for the last time.

There is clearly a bundle to realize about this. I suppose you made some good points in features also. kgaddafgfeeb

I appreciate you sharing this article.Thanks Again. Really Cool. caaaedbggada

I am most definitely going to invest in this! How hard is to believe that this will sooner than later be something we’ll be using on a daily bases? People would of never believed for cars to have screens that guide you when lost and talk back to you or have cars that can automatically park for you? Haha… Something i always remind myself is that, those who envisioned a different future than most of us in the past and now a days aswell get shut down by society. Example: WE all know how Steve jobs started up and his vision. People thought it never happen and that all those stuff would die out and the world would just go back to normal. How wrong were they?

There are people out there that are scared of their homes being taken over by others that might hack into it. hahaha Case is that be a fact. But then how many robberys happen a year as well and we leave on vacations taking those risks either way! The wayy i see it there are wayyy more benefits coming from all this. Plus the younger generations will be more willing since they’ve grown around so much technology already 😉

I love these sorts of talks. I could bet on this whole idea. If some of you would really like to invest $100 and turn it into $600 in a month , than i can help you^.^ I just graduated high school not to long ago and turned myself into an Entrepreneur! Which gives in to why im here haha. Im looking into investing on anything meaningful like many of you guys are. I’ve made it far by myself and i can help many do the same! 😉

Yes I would like to invest each $100 and make $600

So what do you have for us

For what it’s worth, I published on this subject many years ago as a Strategy Research Project at the U.S. Army War College at Carlisle Barracks, Pennsylvania. The paper, which primarily focused on the potential military applications of RFIDS, was titled “Identification – Friend or Foe? The Strategic Uses and Future Implications of the Revolutionary New ID Technologies.”

Should anyone be interested, the following is an abstract:

“Recent developments in identification (ID) technologies are likely to have a revolutionary impact on American society and the manner by which it wages war. The good news is that broader and more creative use of the new ID technologies could enable coalition forces to achieve dramatic victories in the Global War on Terrorism (GWOT) by targeting directly and effectively a critical requirement of most insurgencies: the insurgents’ anonymity. The bad news is that these same technologies may be inherently inimical to the future of privacy and American civil liberties. They could transform our nation and others into surveillance societies concentrating in the hands of central governments levers of control without parallel in human history. How to reconcile American interests and values with the imperative to bend every element of national power in their defense is the central paradox of the GWOT. Are the new ID technologies useful means to the important end of securing the United States against potentially cataclysmic attacks or will they subvert the very interests and values at the core of all we seek to defend?”

I bought SWIR between 19-20 back in July. Sold just below 30 in September and bought back just below 23 in October. The drop right before 3Q earnings had me wondering, but I stuck it out its worked out pretty good so far. I’ll probably hold for a while..

Sierra Wireless at 27/12/14 Price movement actual

(SW.TO) Sierra Wireless 3033.37 c 0.00% 3,033.37 down 0% remove from share watch or buy ? this price looks strong after looking through conversations above

“…listening to their lengthy, insipid videos breathlessly…. ”

Barry Manilow in financial advisory!

I am sitting here listening to this mind-numbingly long, long, long rambling video/schpiel now on MF’s site, under the headline “Bigger Than the Internet: Profit From This Red-Hot ‘Time Machine’ Stock.” This guy is blathering about Bill Gate’s mansion, and a “pin” you get that lets you walk around listening to your favorite music come on the speakers as you enter a room. That’s after he talks about how he wishes he’d bought AOL in 1994, and before he talks about some guy named David who was the greatest investor he ever met, and well before the obligatory Warren Buffet quote.

All I want is the name of the freakin’ stock. This is what hell is like, listening to someone talk in circles about complete baloney when he could have written one sentence.

I assume when he gets to the punchline, it will be SWIR, based on this article here. MF I assume just re-package this endless bloviation under new clickbait headlines.

It seems that things have moved along slightly with regards to this topic. MF are heavily promoting this subject all over again. However this time it doesn’t seem to be SWIR that is going to deliver huge growth it is APPARENTLY a UK Company. Their info says the name of the company is just 4 little words.

Does anyone know who it is?

It’s ARM. Google the name of the executive mentioned in the tease and he comes up as an executive (or VP) of ARM. Pull up ARM’s stock chart for 2009-2015 and it looks identical to the chart they show in the tease. It’s ARM. Now, can someone tell us if ARM is actually a good buy at the moment, based on analysis of its fundamentals (which is beyond me)? Its price is at the bottom of a rising channel at the moment, having briefly dropped through it a few months ago — can any chartists out there tell us if this is significant?

I can tell you that they’re STILL touting this crap now, in December 2016 as I received an MF email today with this pitch in it.

As a technologist, I can tell you that yes, there is potentially a gigantic market opportunity here (though any sensible person can see that, you don’t need to understand the underlying technologies) but it’s been nearly 20 years since people first started talking seriously about this and although we’re fractionally closer to the goal, we’re still a long, long, long way away from it and from my perspective, it will be several years yet (at least!) before anybody investing modest amounts of money will see the gigantic gains which are predicted in this spiel.

Oops – that should say ‘December 2015’, obviously 🙁

https://www.goodreads.com/user/show/57724279-steven-groom

if you wanna check the fool out, take a look in the mirror, just think how smart gardner and his crew have been, getting all the succup’s out there to invest in his newsletter, brilliant on his part, and my bad as well

Amazing how wrong they were on this. I will never trust Motley Fool again……