This article was originally published on June 6, but the ad is running heavily again now as a “recession-proof stocks” pitch so we’re re-posting to answer reader questions. Neither the ad nor this article have been updated since early June.

Whitney Tilson has rejoined the nuclear power parade, launching a new teaser pitch recently for his Commodity Supercycles newsletter at Stansberry (first year $49, renews at $199, includes a one-year trial of Stansberry’s Investment Advisory, also now edited by Tilson). Here’s how the ad begins:

“This Invention Will Create More Wealth than Any Technology in History

“5 times more wealth than cars, smartphones, and computers – combined… yet it fits in the back of a flatbed truck.

“And experts say this technology could see 12,679% growth starting this year.”

That’s generally a “small modular reactors will surge” prediction, which is a pretty common sentiment these days.

When it comes to nuclear power in general, I’m probably “this year skeptical” and “ten years from now optimistic” about new reactors and uranium demand, just because we’ve seen these short-term promises fizzle out as pundits overpromise, and as investors fail to be patient enough to absorb the ridiculous regulatory and development time frames of nuclear power and uranium mining projects… so I at least have some sympathy for the “starting this year” part of the growth promise, even if 12,679% is a pretty bold claim that I imagine falls into that “overpromise” category.

But nuclear power has finally gotten a little bit popular again… both because it is widely seen as a way to fuel the steady-growing demand for “clean” power by the AI-focused data centers we think will be built right and left, owned by companies who have surplus cash and can afford to enter into expensive power purchase deals that ensure long-term access to “green” nuclear energy (it may be green, but it ain’t cheap)… and just because we’re finally getting to the stage where we acknowledge that nuclear power is the only clear path we can follow if we really want to “decarbonize” electricity without rationing power. Solar and wind will presumably keep growing, especially solar, and we’ll also need plenty more natural gas power plants over the next 20-30 years, but if we really want the world to wean itself from coal, rely less on natural gas, and reduce overall emissions, nuclear is the only really viable baseload power option. At least until battery storage or some similar electricity storage technology gets MUCH better, cheaper and more efficient, which doesn’t seem to be in the cards. Maybe the deck will be shuffled for some other reason, or with some new technology, but that’s how it seems at the moment.

The good news is that the “no nukes” baseline stance of a lot of Americans has moderated quite a bit, I think, as we’ve all begun to realize that nuclear power is the most rational way to keep consuming lots of electricity without pollution or emissions — even actor Michael Douglas, a staunch anti-nuclear activist for decades and star of The China Syndrome, a movie that reinforced the fear of nuclear power plants 45 years ago, has changed his mind about nuclear energy.

So I do think we’re in a cultural shift, as we realize that the challenges of nuclear safety and nuclear waste management are solvable engineering problems, and maybe not insurmountable political roadblocks… though these kinds of cultural and social opinion shifts are gradual, and can always turn the other way. Especially if there’s another accident somewhere. After all, even people who believe we need to use more nuclear power are not exactly clamoring for a small nuclear plant to be built in their neighborhood.

And as I’ve written about when covering the waves of teaser pitches about nuclear power being the “AI Keystone” or the “AI Growth Engine” over the past few months, the logic and wisdom of transitioning to small modular reactors (SMRs) to replace coal plants and perhaps even power data center developments over time is real… but it’s also still nuclear power, and that means new developments and construction and permitting and design approvals take forever. There’s been a lot of government support pushed into nuclear lately, but it’s mostly in the form of early-stage funding, not necessarily streamlining permitting or approval processes… so it’s possible we’ll see a commercial civilian SMR built and operating in the US by 2027… but I don’t know if it’s probable. 2029 or 2030 might be more realistic.

So that’s my personal opinion backdrop for this “nuclear renaissance” pitch from Tilson… here’s a little taste of the ad itself:

“By 2030, two-thirds of the world’s nuclear power plants will be running on borrowed time, splitting atoms longer than they were ever designed or licensed to.

“We’re running out of time.

“And this isn’t just happening in America. Fifty other countries are building out their nuclear programs.

“Mark my words: Each of these countries are turning to SMRs to solve their crisis.

“In fact, the International Atomic Energy Agency has already identified more than 80 of these small reactors in development around the world.

“One by one these SMRs will slowly replace over 3,000 of the world’s coal plants… and the investors who see this coming stand to make huge gains.

“We’re at the beginning of a massive growth curve. Right now, the SMR market is only worth $6 billion. That number’s expected to soar 4,800%…..”

So, again, that falls under the category of “I hope so”… but I don’t know when that curve might really begin to turn for the publicly traded SMR developers, especially the smaller and newer ones, and investors aren’t always willing to put up with stories where you have to wait five years for earnings growth.

More from Tilson:

“Let me be clear, this is a long-term investment opportunity, and we’re still at the beginning of its story. Your stake could continue to grow for the next five… 10… 20 years. Is that worth it to you for the payoff I’m showing here? I know what my answer would be.

“So that’s Step 1: Own SMR companies – but they have to be the RIGHT companies.”

And that’s when we get into the clues:

“I’ve just pinpointed one company you should buy immediately.

“The company is already profitable and highly visible. It just beat out a dozen others for more than $400 million in government contracts. Pretty soon, you could see their SMRs deployed around the country after the next hurricane or flood.

“And by the way, the company doesn’t just make SMRs – it’s also a leading contender in uranium production. In fact, it’s received another $120 million in government contracts just for that.”

Again, I’d tell you that “pretty soon” probably means at least three or four years here, maybe more… but that’s almost certainly a tease for BWX Technologies (BWXT), which provides support and fuel for a lot of reactors, including most of the US Navy’s fleet of nuclear powered vessels. Tilson also teased this one back in October, for a different newsletter.

And yes, BWXT is actively developing microreactors, which are much smaller than the typical “small modular reactor” designs we mostly think of as potential civilian power plants, but which would likely first be used by the military to power remote locations or military bases and could certainly grow into becoming a commercial technology. They’re also working on SMRs, but the microreactors are likely to be well ahead of their SMRs.

There’s not necessarily a firm dividing line between “micro” and “small,” the SMRs currently being proposed by a bunch of different groups really run the gamut, from the 10-20MW we’d usually say means “microreactor” to anywhere from 20-350MW for a SMR, and the “modular” part of that term really means these are supposed to be flexible and more easily deployed, so some designs envision one 300MW small reactor, others ten 20MW reactors grouped together. The big dividing line is really that the micro and SMR reactors are mostly factory-built and can be put up quickly, unlike the built-on-site 1GW+ reactors we’re accustomed to, with those iconic cooling towers that still inspire a little fear in many people. All the small reactors are much cheaper and easier to build and operate than conventional nuclear reactors, requiring a lot less land and development time… at least in theory.

Everything takes a long time in the world of government and procurement and nuclear power, though, even in the military (where they don’t have to get permits from every county and identify power buyers before they build)… so even that first microreactor project from BWXT is already about a year behind schedule, I think it’s still waiting for final design approval, but the pieces are being built and it could be completed and in operational testing in Idaho as soon as next year. That won’t necessarily move the needle for BWXT, which is an $8 billion company that gets much more revenue from its fuel supply business (downgrading uranium for use by the Navy and others) and on its sales and service for the Navy’s fleet of reactors, along with radiological supplies to the medical world.,.. but it would be an encouraging sign of what could become a very large business for them, over the next decade or so, if the “nuclear renaissance” really takes hold. And who knows, if this 2025 project works, maybe the military would be ready to engage with some rapid ordering within a few years of that initial testing, and maybe even deploy these microreactors for emergency response projects someday.

BWXT is not a cheap stock, at about 30X earnings, but I’d say it’s still reasonably valued, particularly if you take into account their near-monopoly position in supporting the nuclear Navy, which ought to ensure a pretty steady business for decades… but if growth doesn’t pick up in the Navy, either through expanding the submarine fleet or speeding up aircraft carrier deployment, then they probably do need the microreactor and SMR business to begin to grow in the next few years to make the current price seem really appealing.

That’s pretty likely, I’d judge, but not a slam dunk — I do think the company is well-managed, with a strong foundation of defense revenue, and that means it’s still worth nibbling on now that the stock has settled down a bit, with a ~15% drop from the speculation-driven highs of a few months ago — even without microreactors or SMRs, BWXT has a pretty decent “safety net” in their current, profitable business.

That doesn’t mean the stock can’t get cut in half — nuclear excitement, notably pushed by Porter Stansberry with his Porter & Co. pitches for BWXT last year, has certainly driven BWXT to a higher valuation, but 30X earnings is not wildly out of line for BWXT. That’s only a little above their ten-year average (5-year avg is about 22X earnings), and they’ve been well-managed and pretty shareholder-friendly for a long time, with an efficient business (return on equity near 30%) and a good record of share buybacks and a small but steadily growing dividend (1% yield, so nothing exciting).

If excitement cools and those SMR and microreactor projects by BWXT and others get delayed or snarled in red tape again, and investors move along and lose interest in nuclear power, BWXT could certainly fall back to 15-20X earnings — but their actual earnings should be pretty solidly in the $3-4 per share range even if they don’t get some exciting microreactor growth in the next few years, so that limits the likely downside risk, all else being equal, to somewhere in the $50-60 neighborhood. Not coincidentally, that’s mostly where the stock has traded over the past few years, until the “nuclear renaissance” and the nebulous “AI” connection helped goose BWXT steadily higher, starting about a year ago.

The challenge is really just whether they can juice their growth a little bit, beyond the current revenue growth forecast of about 10%/year, and improve their margins a little as they grow — analysts don’t see that yet, they’re predicting that earnings growth will average about 10% per year, so paying 30X earnings for 10% earnings growth is still a bit of a stretch… but I do think there is some potential for that growth to accelerate. Analysts see that coming in 2026, with almost 20% earnings growth that year, but I’d be more comfortable giving them something more like five years to grow into this valuation — government can move awfully slow, and almost all nuclear work is governmental-driven.

And the strength in BWXT is at least somewhat justifiable, since this is one of the few SMR stocks that has both meaningful potential exposure to growing nuclear power demand, and a real and sustainable business to backstop the valuation if SMRs are delayed a few more years or investors lose interest. There are dozens of companies working on SMRs, including conventional reactor stalwarts like GE-Hitachi and Westinghouse, and other solid businesses that have SMRs as a sideline, like Rolls-Royce (RR.L, RYCEY), and they’ll all probably be steadier than the new crop of “pure play” SMR companies like Oklo (OKLO) and NuScale (SMR)… but my guess is that BWXT is the best potential mix of those things — small enough to be more growth-driven than the traditional leaders like GE-Hitachi, and “pure play” enough to be more exposed than Rolls-Royce, which is still mostly dependent on jet engines… but much larger and less likely to go bankrupt while we wait for progress than the newly public SMR “disruptors” Oklo and NuScale.

There’s also some risk that their overall business could falter if there’s any slowdown on the Defense side, whether that’s because of future budget debates or just because programs slow down a little, like we saw with the aircraft carrier deliveries getting delayed recently, and future procurement also pushed off a bit into the future (USS Enterprise will be delivered 18 months late, partly driven by the failure of Huntington Ingalls to hit their planned schedule, due at least in part to the shortage of skilled labor and COVID-driven issues in recent years, and given the limited shipyard capacity any delays run downhill… and the Navy this year pushed off procurement of the fifth new carrier from 2028 to 2030, interfering with the typical schedule of “one every four years” and causing some panic among industry lobbyists)… though it’s likely that the ongoing maintenance and refueling projects for the nuclear fleet will continue to provide pretty steady order flow over longer periods of time, and a lot of the work is not optional.

I’ve been saying essentially that same thing about BWX Technologies (BWXT) being the most appealing “middle of the road” exposure to SMRs since March of 2023, though, and have never owned the stock… so it seems silly to keep that up. I’ll finally buy a small entry-level position today, as the stock settles down in this “dip,” and will keep covering it for our Irregulars. Maybe we’ll see a return to the $60s if sentiment fades, but it’s also quite possible that growth will pick up to a surprising degree in the next year or two — I’ll stop waiting, and add it to the Real Money Portfolio today with a small buy.

What else does Tilson talk up this time?

“You need to own the best nuclear operators in the U.S.

“And I’ve already identified two names you absolutely need to know about:

“Company No. 1 currently owns or operates almost half of the nuclear power plants in America. It’s a Fortune 200 with plenty of room to run. It’s also a big recipient of the tens of billions of government earmarks just for clean energy production.

“The company’s sitting on almost $400 million in cash as of the 4th quarter of 2023, and it’s not afraid to put its money where its mouth is. Last year it spent $1 billion buying back its own stock, and it has just announced plans to buy back another $1 billion of its shares.

“To top it off, its biggest investors include Vanguard and BlackRock, which most recently owned almost 60 million shares between them.”

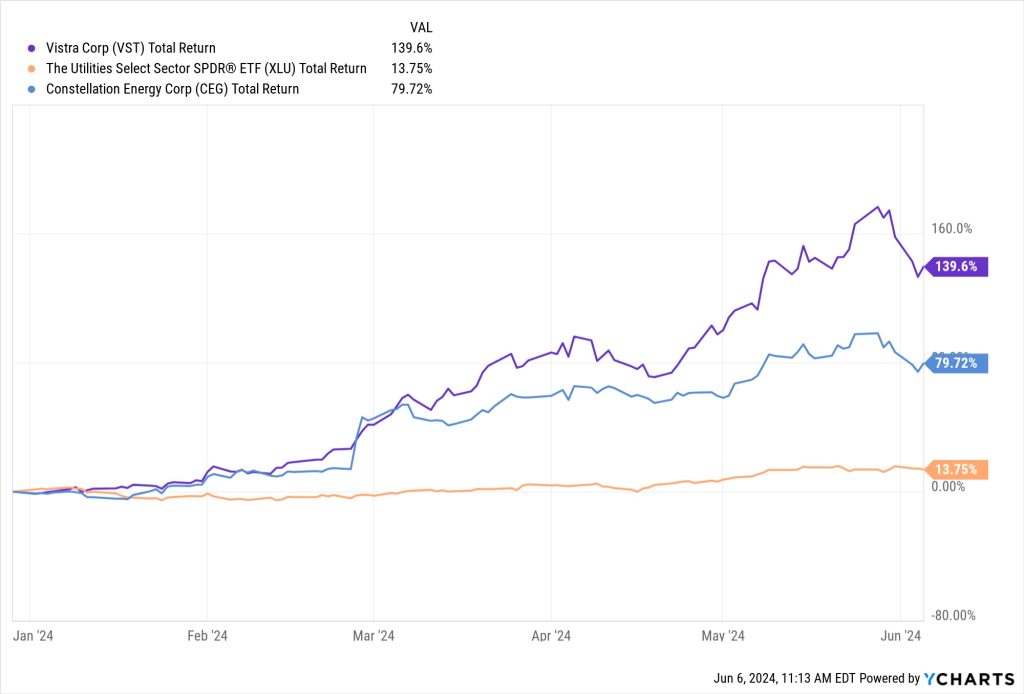

That’s Constellation Energy (CEG), which is another repeat — Tilson also pitched this as part of his “Project E-92” pitch back in October of 2023 for one of his now-closed Empire Financial letters. And it was a great pick at the time, even better than the solid performance of BWXT — it has almost doubled in price since then, thanks to rising enthusiasm about utilities in general, as chatter picked up about AI’s insatiable demand for electricity, and particularly as investors became interested in independent power producers who can sell nuclear-generated electricity at market rates. Hard to argue with Constellation, though it’s truly massive and trades at a pretty rich valuation (~26X earnings), with analyst estimates of 5-10% earnings growth in 2025 and 2026.

What’s the other one?

“Company No. 2 is the largest competitive power generator in America, serving 20 million homes… but I bet you’ve never even heard of it. Right now, it’s only the 4th-largest nuclear energy producer, but it just acquired one of the nation’s biggest nuclear fleets. So it’s about to become the next biggest competitor behind the other company I just told you about.

“And if you need any more urging, its biggest backers include billionaires Ray Dalio, Steve Cohen, and Dan Loeb. You should follow their lead.”

That’s Vistra (VST), which Tilson also pitched back in October of 2023… and that’s been an even more fantastic pick, almost tripling since then. Their acquisition of Energy Harbor turned them into one of the biggest nuclear plant operators in the US, adding to a retail business in Texas and a lot of exposure to volatile (but currently trending up) wholesale power markets, with good exposure to renewables and some new gas plants as well as some legacy coal plants that will probably be eased out in the next few years. Their growth has been phenomenal and extremely well-timed, and the investment “story” is really the nuclear edge and the fact that electricity demand overall is surprisingly growing overall (a year ago, the assumption was that demand would grow 2-3% overall… now estimates have that closing in on 5%, which is a big enough jump in peak demand to make regulators nervous and inspire more work on generation and grid upgrades).

I have a really hard time judging the value of “growth” utility stocks, but it’s hard to argue with Vistra — they do carry a lot of debt, like most utilities, but the earnings are likely to grow very nicely this year, thanks largely to that acquisition closing, and keep growing. Analysts think they’ll be earning $7.44 per share in 2026, which would be 50% growth over the next two years, and as of today the stock trades at a little under 30X trailing earnings and about 17X 2024 earnings. The dividend is minimal, as it is at Constellation these days, so this doesn’t trade like most utility stocks, which have historically mostly been interest-rate plays… but, kind of like BWXT, the valuation is getting a little more rational again after a spike to well over $100 last month.

I shared the Business Breakdowns podcast episode about Vistra with some of our readers back in December, and I was encouraged by the potential at that time, but I sadly didn’t buy (it was below $40 at that point), and, as is so often the case, I got too anchored on the price back then and resisted chasing the stock as it surged higher. It’s hard not to conclude that the stock has gotten “overheated” amid all the talk about rising electricity demand from data centers and AI, and the general rise in utility stocks, but I’m also tempted to nibble on a few shares at this point, as the stock finally has a pullback.

There’s also some meaningful downside risk if it begins to act like a “regular” utility again — here’s a more cautious take from a Morningstar analysis, for some perspective:

“We assign Vistra a High Uncertainty Rating primarily due to its exposure to wholesale and retail energy prices.

“Vistra also has operating risks. The company must keep its plants operating at high availability levels to take advantage of the times when there are high margins in the wholesale power markets. Vistra also must manage its retail supply risk to protect against unexpected spikes in customer demand and market prices.

“The winter storm that hit Texas in February 2021 demonstrates the operational and financial risk that Vistra faces. The company reported a $2.9 billion pretax loss related to the storm due to disruptions in the natural gas market during peak energy demand periods. A lack of gas supply forced Vistra’s plants to shutdown and required the company to buy power and gas at exceptionally high prices to satisfy its customer commitments.”

Their analyst just reaffirmed his $43 “fair value” price for VST, and included this note:

“We agree with market forecasts that electricity demand growth will accelerate, particularly in Texas. However, fast-growing renewable energy development and new subsidized gas generation could hurt margins for Vistra’s fleet.”

That’s not supposed to happen with utility stocks… and yet, Vistra trades at a discount to the average utility, at least on a forward PE basis. That’s because it’s a much more volatile business, without as much exposure to regulated businesses as most utilities, but that leverage to growing electricity prices and demand could keep working in their favor for quite a long time if the anticipated growth in US manufacturing comes to pass, including new semiconductor plants, while data center proliferation continues to be aggressive.

Both of these companies are quite phenomenal, and they’re both in the right place at the right time, as the market refocuses on how valuable the old fleet of nuclear power plants can be over the next decade or two in helping with the transition to renewable energy (and as federal incentives for sustaining those old nuclear plants kick in this year) — Constellation is much bigger, likely to be more stable, and even more exposed to nuclear power than Vistra, and less reliant on the volatile Texas market… but Vistra is cheaper, and more aggressive in managing for growth and buying back shares, probably because of its private equity roots coming out of the 2014 TXU bankruptcy.

I’m entering Vistra with a small nibble, after this 20% dip from the highs last week… I’m not entirely sure about the valuation, so this is a smaller stake than with BWXT, but it’s enough for me to take it seriously and watch it more closely.

Moving on…

“And the other push is for the fuel for these plants, uranium…

“We don’t have enough uranium. Nowhere close.

“Right now, we need about three metric tons of it to keep the lights on, and the government estimates we’ll need 400 metric tons by 2030.

“That’s a growth of 13,000% in the next few years.

“Today, we’ve only got a handful of working uranium mines left. We’re totally dependent on uranium imported from other countries.

“And one of our biggest suppliers? Russia.

“You might remember President Biden made a big deal about sanctioning Russia over Ukraine. But what you probably don’t know is at the same time, we were quietly paying Russia billions of dollars for their uranium.

“Thankfully, the federal government has finally declared this a national security risk, and is acting accordingly.”

Uranium has certainly surged, finally, after that surge has been predicted for almost a decade… but Tilson thinks it will move higher still…

“Unless we move fast, we’re going to be short 40 million pounds of uranium a year for the next decade. Utility companies have spent the last two years stockpiling uranium, expecting our Russian supply to get cut off any day.

“Countries around the world – including Canada, France, Japan, and the U.K. – are scrambling to do the same. In fact, the U.S. just signed an agreement with all these countries to build a strong uranium supply and wean the world off Russian uranium….

“Prices have doubled in the past two years – and in January, they just broke the $100 mark for the first time since 2007.

“I’ve got two uranium stocks for the top of my recommended ‘buy’ list. You’ll also find their names and ticker symbols, plus a full write-up of each, in my newest report: The Top Stocks for the Nuclear Renaissance.”

Sadly, Tilson doesn’t hint at which uranium stocks he likes in any way… so we’d be left to guess on that front. We might start with the three uranium picks he made in his earlier “Project E-92” pitch for nuclear power, back when he still had his own publishing house and was promoting Empire Financial’s Energy Supercycle Investor (Empire was absorbed by it’s half-owner Stansberry this year, part of the huge post-2022 shakeup in the investment newsletter business as subscriptions collapsed). At the time, he was touting Cameco (CCJ), which is the obvious choice as the only major publicly traded pure-play non-Kazakh producer of uranium (almost entirely in Canada)… and also pitching Energy Fuels (UUUU, EFR.TO) and Uranium Energy Corp (UEC).

I don’t trust UEC at all, mostly because of their highly promotional past (just writing about the stock got me embroiled in an attempted class action lawsuit a decade ago), but the go-to institutional bet for uranium will almost certainly remain Cameco, if prices remain high — their reserves are phenomenal, and they’ve proven that they can adjust production and operating costs to handle the ups and downs of the market, even as they provide uranium to power plants on long-term contracts. The other likely candidates for betting on uranium, unless you want to get very specific with speculating on the large number of junior uranium explorers who will probably never build a mine (but can sometimes jump 1,000% anyway), would be the mining ETFs, Sprott Uranium Miners (URNM) and Sprott Junior Uranium Miners (URNJ)… or the Sprott Physical Uranium fund (U.U.TO, SRUUF), which is probably the closest we can get to actually buying the metal itself (there’s no real “spot market” or futures market for uranium, it’s almost all sold on long-term contracts, and is of course highly regulated). You can also look at the fuel enrichment/supply side, between the miners and the consumers, and there are some reasonably valued companies in that space who might do well — including Centrus Energy (LEU), which we wrote about last month.

And if you just want to play the theme for a year or two, without dealing with individual stocks, you could also just go with the pretty good Van Eck Uranium + Nuclear Energy ETF (NLR), which owns many of these companies and gives exposure to service providers, power generators and uranium miners.

Finally, this ad for Tilson’s Commodity Supercycles also includes some teased “bonus reports” that we can shed a little light on…

“The Secret Currency: How to Make 500% from the U.S. Government’s Second, Secret Currency” is all about gold coins — that’s been a favored pitch of several Stansberry folks over the past 15 years or so, mostly starting with Steve Sjuggerud, and I took an updated look at their most recent version of that pitch last month.

“The No. 1 Gold Stock to Buy in 2024” is the ongoing pitch from this newsletter for Sandstorm Gold (SAND), one of our favorite royalty companies (but a very long-term under-performer at this point, mostly because they got a little too hyper with their dilutive acquisitions in recent years… and have had ongoing setbacks with their key Hod Maden project/royalty in Turkey). I write about this one pretty regularly, but last updated my coverage of this Stansberry tease in April.

The first editor of this Stansberry newsletter, Bill Shaw, started the ball rolling when he called Sandstorm his #1 gold stock back in 2019, and they’ve essentially just updated that pitch once a year or so since then. Investors have largely given up on SAND and pushed it down to the lowest valuation among the major gold royalty companies over the years, which has led the stock to be the worst performer in the group since 2018 or 2019… but that lower valuation also means it probably has more potential to “catch up” if we happen to have an ongoing gold bull market. Hasn’t happened yet, so both Shaw and I have been wrong about this one so far. We’ll see if Tilson continues that unfortunate tradition.

And that’s all I’ve got for you today… have some feelings or opinions about nuclear power that you’d like to share, or reasons why you’d prefer one of these stocks over others? Let us know with a comment below. Thanks for reading!

Disclosure: Of the companies mentioned above, I own shares of Vistra, BWX Technologies and Sandstorm Gold. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I was in BWXT at $73 just prior to you October piece. See my comment there for my view then. Short answer is that this is the ONLY company with verifiable experience and knowledge in the SMR area. Plus, it is a verifiable profitable, well run, and well financed company. Not sorry I didn’t sell @ 109 – This puppy goes into the long-long-term-investment bucket.

Well done! When it comes to “only,” it depends on what you mean by “SMR,” because the BWXR-300 from Ge Hitachi is arguably very well accepted, and the first ones should be under construction in Ontario pretty soon, and that’s effectively the tenth generation of their light water reactor design, just downsized — but that’s what I’d call a very large SMR, 300MW, and each one will probably cost a billion dollars and could roughly replace a typical natural gas power plant by itself — a good alternative to conventional reactors, and provides some hope for broader global growth, but probably not nearly as flexible as the smaller and more genuinely modular SMR designs that we mostly think of with that “SMR” term (and far less flexible than BWXT’s relatively tiny microreactors). Westinghouse has a similar 300MW SMR, also based on a scaled down version of its proven large reactors, others might as well. Don’t know if those downsized reactors count as “proven” yet, but the folks who have actually built commercial and/or military reactors ought to inspire a lot more confidence than the much smaller SMR startups, nobody wants to take extra risks on these kinds of projects.

And as another positive, BWXT is one of the few suppliers in this industry — so they got the contract to build the containment vessels for those BWXR-300 project in Canada. They probably stand the best chance of having at least a piece of a lot of this work, whether or not they are the prime contractor or actually build the reactors.

The first SMR I heard of was brought in by truck to a mountain top in Wyoming for the Air Force in about 1960. Why can’t the general public have access to these small reactors? The Navy seems to have a monopoly on them. Why not bring the ships back to the U. S. ports and hook them into the grid? That would do more good than sending the ships all over the world to destroy some other country. It’s tragic that our government does more economic harm than good.

In the uranium space, it looks to me like the currently producing ISR mines are the best bet. Their costs per pound of U3O8 are much lower than the average costs for CCJ. ETF’s, no matter the commodity, are a joke. One, WEAT, has a portfolio consisting of 98.5% short term paper and 1.5% futures contracts.

I have found that royalty companies are not a good bet because most have portfolios full of mines that aren’t producing, but might in the future. Their yields are dismal. The oldest ones (Wheaton) might be OK, but the newest (Gold Royalty) continually promise big yields in the future. I’d like my money to work harder for me than that.

Doesn’t seem there’s been much logic to the nuclear power business since the early 1970s… but who knows, maybe that’s gradually changing. We’ll see if that sticks — BWXT, for example, also had a previous attempt at SMRs a decade ago, with pretty good buy in from industry, including a partnership with Bechtel (which also designed the latest reactor now being used in aircraft carriers) and a tentative plan to build a plant for the Tennessee Valley Authority in 2013, but that mostly fell apart by 2017, though similar initiatives are picking up steam now. There seem to be no guarantees, but I’ve never seen people in general so positive about increasing nuclear power production in the US. We’ll see.

Only the aircraft carrier reactors are really big enough to make much of a civilian impact, I would guess — from what I can tell, the latest ones are the equivalent of about 400MW each, and each new carrier has two reactors (though more than half of that power is not electricity output, it’s direct horsepower going to turn the propellers)… subs have somewhat smaller reactors. I don’t think there are any non-carrier surface ships remaining in the fleet that are still nuclear-powered. The UK, France and Russia have a bunch of nuclear ships and boats, though I think mostly submarines for them, too.

I have owned Wheaton since early 2009 and have seen my shares rise from $4.11 (Canadian funds) to over $70. WPM is the best long-term streaming investment available today. They pay a rising dividend at $0.62 per year and allow dividend re-investments at a small discount. Randy Smallwood CEO is highly respected for his stewardship of WPM since its inception. A well managed, “good” company to own.

Speaking of SMR’s, whatever happened with Rolls-Royce (RYCEY)? I got them when they were <$2, now $5+. As I understood it to be, RR has been commissioned by the British Gov't to begin producing these SMR's; They've already got the technology so it's not like they just fell off the back of a turnip truck. We'll probably see their SMR's in this country before we see any homegrown products.

Don’t forget another reason to own RYCEY is the subscription model they have implemented on the jet engine production, which will create a regular and predictable cash flow.

Yes, that’s the primary reason for owning Rolls-Royce for the foreseeable future. That’s no longer unique, though — essentially all the engine suppliers do that now, and Rolls-Royce has been using that model for something like 20 years. The change over the past couple years was some management reorganization, cutting a bunch of smaller-scale programs, and, most importantly, finally having air travel grow again… particularly in Asia. They need to get some new design wins for their next generation engines (and avoid any screwups in those engines), and hope that Boeing and Airbus can keep up with demand, but things sure look better now than they did when air travel was at low levels for a few years.

Rolls Royce is also a comeback story – in that they got badly overextended a decade ago and have been mending. Roughly simultaneous with management reforms they were slammed by the pandemic with regard to the flying hours you mentioned. Along with RR Aircraft engines and modular nuclear (I believe they are now delivering units to UK government sponsored sites) they have MTU the manufacturer of diesel and clean fuel motors and several other technically complex product lines.

Consider TALEN ENERGY (TLNE) which owns, among other things, a nuclear facility in Pennsylvania that would cost perhaps $40 billion to duplicate. The COMPANY has just tendered for a substantial chunk of its own stock because they know how undervalued it is. It’s a profitable post bankruptcy play, too new and small now to be listed on any exchange or covered by Wall Street.

Similar kind of story, though it has also doubled this year. Have never looked into the numbers for TLNE, thanks!

Oklo. backed by Sam Altman. is working on a plant in Ohio. They provide energy to AI customers among others like, data centers, energy, defense, and industrial markets.

Yep, if I remember correctly they’re still talking up the idea of building that Ohio plant by 2027… which seems pretty optimistic, but we’ll see. I wrote some about Oklo here.

Thanks Mr. T

Yes, seems many of the uranium stocks, ETFs have been doing well for awhile (except UROY). Wonder if the theme “we need way more power generation for AI” going to really play out…

Also, surprised not seeing a ton of cannabis related newsletters since it is looking like a new “Final Rule” likely coming before the election…could lead to a backdoor play for some banks or financing related stocks?

There was a coiled spring aspect to uranium for many years, just because we’ve been using up some above-the-ground surplus (all those German and Japanese reactors that shut down after Fukushima had refueling contracts, for example), and that led to the price of uranium drifting below the price that’s needed to spur more mine production. It’s now high enough that Cameco can profitably plan to produce more, for example, and the ISR plants can be maxed out, so we’ll see if that is enough. From what I can tell there is no actual shortage of uranium production capacity, even though we don’t really mine much in the US and depend on imports, but the low price has certainly kept any new projects from being financed and built, so we might see the old commodity rule resurface here: “the cure for high prices is high prices”

It’s a strange commodity, because the price of uranium matters very little to the operator of a nuclear power plant — the fuel is a much smaller part of the operating cost than at a gas or coal plant.

With regard to Vistra, I also read the Morningstar report, but CFRA was more favorable, rating it a “buy”. It looks like the down elevator on price may have stopped for the moment, for buyers, if any (not me). I’m more interested in Texas’s lack of grid reliability as a customer, after I and my family froze in the dark for three days during winter storm Uri. We and our neighbors got through it huddled by the gas fireplace in sleeping bags. Ironically, there was enough gas supply for us, even though tho the generating plants couldn’t get near enough to prevent the blackouts. Depends on who is squeezing the pipeline, I guess. Anyway, progress on fixing the issue is nonexistent, in spite of the TX customers voting to provide funds for it. Thus, we are susceptible to a repeat the blackouts for the next several years.

Sounds like it’s still a mess down there… hope they get it fixed up before the next winter storm!

Any views on the prospects for BWXT if Mr Trump is re-elected?

I don’t expect the election to make a difference with this one… unless whoever is elected presides over a grand bargain that shrinks defense spending by a meaningful amount, then all the government suppliers would be hurt. BWXT’s revenue would likely be relatively stable even if that happens, but a lot of their revenue is service and parts for new reactors for submarines and aircraft carriers, so delaying some of that procurement by a year or two would hit their income statement by at least a little bit.

The Repub’s like dirty energy…..OIL and Gasoline and Coal………………The Dem’s like Clean energy…Solar and wind , nuclear and hydrogen……..That’s the Future , not the Past…. Just like our Candidates!

Since when have the dems liked nuclear energy? LMMFAO

Gradual change over the past ~5 years… started with hardcore environmentalists who began to realize it was the only way to cut emissions, but the logic has won over more democrats over the past few years as the reflexively anti-nuke/nuclear freeze folks from the 1970s and 80s have softened. Similar to the growing acceptance of nukes again in the broader population — more fear of potential climate crisis, less fear of nuclear accidents or nuclear proliferation. I think it’s mostly just logic winning out, which sometimes takes a long time when fear is involved — you can’t reduce carbon emissions without nuclear power, not unless you expect the people of the world to consume less electricity.

Adam ODell has been promoting small nuclear reactors, extolling a company that has several critical patents. He made the mistake (in my opinion) of showing a photo of the main patent with the company’s name blacked out, but the patent number in plain sight. It was easy to go to the patent office and discover that it is NuScale Power SMR. Any thoughts on its potential?

Yep, I wrote about that Adam O’Dell SMR teaser pitch last month.

Unless a new project jumps the line, NuScale’s first reactor is planned now for Ohio, with a goal of being online by 2029… but they haven’t really done anything on that project yet, from what I can tell, and the red tape is still thick and the cost pretty high for these initial SMR projects… so folks are a little cautious following the cancellation of their first reactor project (by the customer, largely for financial reasons) at the end of 2023.

IAN WYATT just ran a whole nuclear power pitch. He is calling it “HYPER POWER 2.0”, and emphasis is on the trend of data centers building next to nuclear power plants to tap into for 24% of their power needs. He is promoting his Wyatt 10x service by hinting at 5 mystery nuclear stocks.

#1 ???

-stock is less then $10.00, it has locations in Texas and Wyoming, is run by a former head of Department of Energy, and $585 million in sales.

#2???

Is associated with Chat GPT, and they are building attractive new plants, that look like A-framed mirror surfaced structures, so they blend in with the environment and almost disappear into the landscape. Future locations in Ohio, Idaho, Alaska (US gov involvement), and use recycled fuel from conventional reactors. I think this one was also around $10.00 a share.

#3???

Has a $150 million dollar government contract, and is the only company licensed by the US government. Near Washington D.C. and has a monopoly on Uranium supply.

#4???

$283 million from US government, 600 patents, building small plants in Ohio and Pennsylvania, Is a $500 million dollar company and is trading for $5.00 a share.

#5.???

Trading for less then $2.00. Located in Northern Sascatuan, Canada, bought 70,000 acres right next to the Cameco plant. Has no debt, owns existing mines, and has uranium inventory.

There were probably more clues but I could only scribble so fast and could not read half of my notes. Thoughts on these?

Just going from memory, the first four sound like UEC, Oklo, Centrus and NuScale

folks, forget all the above. this time Stansberry is correct. It’s all about BWXT. It’s been going good for me. Slowly goes the race, but the rest of all the names are years behind, so they are academic. Only BWXT is now. It’s the first one. It’s the major first mover, and it’s done a lot of business for years already for thfe Navy, and that’s all we need to know. The others are all smoke and dreams.

I took a small position in NUKZ based on your super comprehensive writing on this subject is been flat for the most part but I believe in this sector. Thanks for all you do!

Hope that works out for you! If we do really have a nuclear power renaissance, I think it’s likely to be a marathon for the companies involved, not a sprint, so I’m not betting on short-term gains… but I do think the business should grow meaningfully again over the next decade, after a lot of languishing both globally and in the US.

If you want to invest in the SMR space, BWXT de-risks things significantly with their 70+ years of making SMRs. It’s worth noting that their current reactor development is on-hold pending the next continuing-resolution getting passed by the Federal Government. It’ll probably get approved, but beware that the path to revenue for any SMR company is a long one, even BWXT.

Porter has just started pushing BWXT with a new video presentation

He’s been running with that one since the Spring of 2023 (https://www.stockgumshoe.com/reviews/the-big-secret-on-wall-street-this-week/de-tease-porters-secret-energy-grid-obamas-screw-up-and-reagans-premonition/), but yes, the ads continue to roll teasing BWXT.

Stansberry Research recently sent a report to me with the title: THIS INVENTION WILL CREATE MORE

WEALTH THAN ANY TECHNOLOGY IN HISTORY. A photograph was included with a picture of a

FUEL ROD suspended on a large chain…commented as ” it might look like raw metal in a forge’

Further: ” One of these can power 60,000 homes and produce more energy than fossil fuels; with none

of the carbon dioxide or air pollution.

WHO IS THIS COMPANY?????