Answers: Whitney Tilson’s Seven “Secret Project E-92” Stocks

by Travis Johnson, Stock Gumshoe | October 4, 2023 3:32 pm

Energy Supercycle Investor teases about a nuclear renaissance to begin on October 10, including seven "secret" stocks... so what are they? Thinkolator results below...

Here’s the intro from Whitney Tilson[1]’s latest ad for his Energy Supercycle Investor[2] ($995/yr, no refunds — 30-day window for publisher credit if you don’t like it):

“An Urgent New Prediction from Financial ‘Prophet’ Whitney Tilson

“Washington’s Secret “Project E-92”

“This groundbreaking new tech/policy initiative could trigger the greatest moneymaking opportunity of the 21st century… Especially if you’re holding these 7 stocks by October 10th”

And what’s that October 10th bit about?

“It just so happens that the biggest ‘supercycle’ development in energy on my radar right now…

“The America-led, global shift to nuclear electricity generation I’ve been showing you today…

“Perfectly coincides with the one-year anniversary of Energy Supercycle Investor.”

I don’t know why that would matter, but what that October 10 date is really about, Tilson says, is a possible “catalyst” for interest in nuclear power[3]…

“For 60 years running now – almost as long as America has had a civilian nuclear power industry …

“There’s been a prestigious, intensive annual seminar on the nuclear power industry that many insiders consider a ‘must attend’ event….

“… my gut feeling is that this year’s three-day conference is going to be unprecedented in its overall attendance, its government presence, and potentially, its media coverage.

“Normally, these things don’t get a lot of outside press.

“But with the increasingly pro-nuclear rhetoric coming out of Washington…

“The boom in bipartisan legislative and funding love for nuclear power on Capitol Hill…

“And the sudden decisive swing to ‘net positive’ public sentiment for nuclear electricity…

“The mainstream media is starting to get hungry for stories about atomic energy….

“It could be the match that lights the fuse on all seven stocks you’ll find in the new Energy Opportunity Dossier I’ve prepared specifically for this urgent situation.”

Could be, I guess we’ll find out — seems somewhat hard to imagine anything bipartisan happening at the moment, but that doesn’t mean there won’t be a flurry of press attention… and press attention does sometimes drive stock sentiment. I can’t say that I’ve got a “gut feeling” on the timing of all of this, but Whitney Tilson has sometimes gotten those “gut feelings” right as an investor, so perhaps he’ll be right this time… even if it seems quite likely that the specific “October 10” date is really mostly there to serve as an artificial deadline to encourage people to sign up for the newsletter (ads need deadlines… the longer you wait to pull out your credit card, the higher the likelihood that you’re going to think it over and decide you don’t need to spend $1,000 to learn about a handful of nuclear power stocks).

It has been a relatively good year for the nuclear power industry, as we saw the first new reactor in Western Europe in 15 years go into service (in Finland), and the first new reactor in the US in seven years in Georgia (there have been only four new nuclear reactors built in the US in the last 32 years, two of them in this century). Almost all US reactors were built in the flurry of reactor construction from the early 1970s through the late 1980s, and the number of reactors in operation has been shrinking for a long time as the first wave of reactors from the late 1960s and early 1970s have been closing down (helping to keep a lid on uranium[4] prices, particularly as weapons production cooled, old weapons were recycled into fuel, and cheap natural gas[5] took over as the favored power generation fuel).

The interest in nuclear power has come both from encouraging new smaller-reactor technologies that might be safer, as well as from the growing awareness that nuclear power, though it creates its own waste challenges and still seems frightening to a lot of people, is much safer, in the big picture, than coal[6], provides steady baseline power that renewable sources cannot, and creates no carbon emissions or air pollution. Plus, it has now been 37 years since the Chernobyl disaster, and a dozen years since the Fukushima meltdown, and I guess that helps the horror of those nuclear accidents to fade. At least for folks who don’t live nearby.

The companies who have pretty direct exposure to the nuclear power industry, the suppliers and the uranium miners, have had a pretty good year as uranium prices have ticked up in 2023, and that has a lot of investors hoping for a repeat of the previous uranium bubbles that peaked in 2007 and 2011, particularly because uranium prices still aren’t high enough to encourage more exploration or mine development. So what is it that Whitney Tilson thinks we should buy as a play on nuclear power?

[7]

[7]His first ‘special report’ is called “Up to 300% Gains on Two ‘Bedrock’ Stocks for America’s Nuclear Energy Revival” … so let’s see what clues he drops there:

“Must-Have Nuke Stock #1: ‘Smooth Operator’ of U.S. Atomic Power

“By market cap, this company is the largest of the seven firms I’m recommending in my new Energy Opportunity Dossier…

“But it’s not too big to potentially go on a tear….

“Not long ago, it was the ‘parent’ firm of the primary utility provider in a once great, but faltering city in the eastern U.S….

“Then it was acquired by a utility juggernaut and spun off into a standalone entity last year.

“Along the way, they’ve parlayed a series of shrewd mergers, acquisitions, and joint ventures into a prime position as a major provider of electricity, gas, and energy services.

“Today, they have approximately two million customers across the continental United States.”

OK, so it’s a pretty big utility company. Other clues?

“But the part that’s really got me licking my chops is the fact that over 85% of the electricity they provide to those customers comes from nuclear power plants.

“And with the recent Inflation[8] Reduction Act putting sideways pressure on the electricity industry to go low-carbon…

“This company’s in perfect position – and could easily double over just the next three years. That’s an impressive potential return for a $30 billion utility firm.

“Put another way – this firm is one of the purest plays on mass-scale nuclear power generation you can make, anywhere.

“Shares have been steadily climbing for four straight months – they’re up 45% even as I speak to you now.”

Thinkolator sez this one is Constellation Energy (CEG)[9], which does have its roots as the owner of Baltimore Gas & Electric a couple dozen years ago, but was part of the big Exelon utility conglomerate for a long time until it was spun off from Exelon last year as primarily the owner of nuclear and renewable energy[10] generation assets.

The stock is on the expensive side for a utility, at about 22X forward earnings, and it is not as aggressive a dividend-payer as most of the companies in this space (current yield about 1%), but they have also done a fair amount of share buybacks, and it is indeed one of the US utilities[11] that is most aggressively exposed to nuclear power generation, with a large fleet of reactors and a strong likelihood that their current reactors will receive license renewals starting in a decade or so, extending most of their nuclear power generation capacity until at least 2050, with much of it likely to be operational for decades beyond that (reactors were almost all built with 40-year licenses, and can get two 20-year extensions). Here’s how they describe themselves:

“Constellation is the nation’s largest producer of carbon-free energy and the leading competitive retail supplier of power and energy products and services for homes and businesses across the United States. Headquartered in Baltimore, our generation fleet powers more than 20 million homes and businesses and is helping to accelerate the nation’s transition to clean energy with more than 32,400 megawatts of capacity and annual output that is 90% carbon-free. Constellation has set a goal to eliminate 100% of its greenhouse gas emissions by 2040 by leveraging innovative technology and enhancing its diverse mix of hydro, wind and solar[12] resources paired with the nation’s largest carbon-free nuclear fleet. Constellation’s family of retail businesses serves approximately 2 million residential, public sector and business customers, including three-fourths of the FORTUNE 100.”

So… yes, CEG is probably going to benefit from the inflation reduction act incentives for clean energy and nuclear power, so that should help. Right now, the average utility (as measured by the XLU ETF) is valued at about 19X earnings, with a dividend yield of about 4%, and this is a sector that has primarily been of interest to risk-average income investors in the past… but that is changing with the surge in interest rates, and utilities are somewhat beaten down as a result, so some of those dynamics that we got used to have been turned upside down. This is the first time since the 2007-2009 Great Financial Crisis that the dividend yield on the XLU ETF (3.75% right now) is lower than the yield on the 10-year Treasury Note (4.7%), and it’s true that the utilities generally did well if you bought them in 2003, the last time their dividend yield ticked lower than the 10 year “risk free” rate (it mostly stayed lower for the next 5-6 years), but they did also benefit from the fact that interest rates generally fell over the past 20 years, until, well, this year. Here’s what the average performance of the utility sector looked like since January of 2003.

[13]

[13]

And here’s the reason for optimism…. it’s a short time frame, but since being spun out as a separate company last year, investors have clearly endorsed the idea that Constellation Energy is more appealing than the average utility…

[14]

[14]

So that’s a relatively stable nuclear power play, and a very large one… it will probably trade in line with the utilities most of the time as it matures, but it does certainly have that “kicker” that if we incentivize nuclear power and begin to consider it more valuable than conventional gas generation (or whatever), CEG could continue to get a boost from investors.

What’s next?

“Must-Have Nuke Stock #2: A Rising Superstar of ‘Energy Transition’

“This company is an integrated power producer (IPP) that’s well positioned in the emerging ‘energy transition’ industry.

“In certain deregulated markets, these IPPs are allowed to ‘piggyback’ on the grid to offer their services at cheaper prices than the main utility provider…

“The twist is that this IPP stock has big exposure to nuclear-generated electricity – and it’s about to get bigger…

“Because they’re currently in the process of purchasing another energy firm with one of the largest nuclear fleets in the U.S.

“Once this deal is inked, they’ll have around five million domestic customers…

“Many of which will be using nuclear-generated electricity….

“Since early May, they’re up over 36%.”

That’s Vistra Corp (VST), which is indeed acquiring Energy Harbor[15] and, assuming the deal is successful, will own the second-largest “fleet” of nuclear power plants in the US (right now they’re the fourth largest, and Energy Harbor is second). They came out of a major bankruptcy in the Texas electricity market about seven years ago, began to expand by buying Dynegy in 2018, and the company they’re acquiring now, Energy Harbor, used to be part of FirstEnergy and owns nuclear plants in Ohio and Pennsylvania.

Vistra is not as nuclear-driven as Constellation, and it’s nowhere near as large and has a more concentrated customer base, but they are growing much more quickly, even if that’s largely through acquisitions. The stock is also quite cheap compared to the regulated utilities, it trades at about 8X earnings and carries a 2.5% dividend yield. I don’t know much else about this one — they’re not quite as cheap as fellow Texas-focused IPP NRG Energy (NRG)[16], which carries a 4% yield and is at about 5X earnings, even though NRG also owns some home service businesses… but unlike NRG, they do have that large fleet of nuclear plants. Interesting idea, I’ve not considered any of the IPPs in the past, the more stable regulated utilities have generally been more interesting to me for that “widows and orphans” part of the portfolio, but I can see why you’d light on Vistra as a more appealing one.

(I don’t know that I’ve ever bought an individual utility stock, by the way, this is not my area of focus, but I did buy a bunch of XLU during the 2020 crash, and I still own some of that).

So those are Tilson’s bigger, pretty conventional utility companies that have meaningful exposure to nuclear power. What else does he recommend for this “Secret E-92” theme?

His next special report is called, “Up to 2,000X Gains on Two Pioneers of Scalable Nuclear Electricity.” We’ll run through the teaser hints one at a time…

“Must-Have Nuke Stock #3: Military Darling That’s Branching Out

“This firm is a pure nuclear play, with 80% of revenue coming from government contracts.

“In fact, they just landed a $428 million contract with the DOE’s National Nuclear Security Administration for uranium conversion and purification.

“But on the commercial side, the firm’s diversifying into the “life extension” business for nuclear power plants. This represents a potentially huge and sustained source of profits…

“Especially since the U.S. has recently upped its life-span threshold for nuclear power plants to as much as 80 years.

“Both of these aspects of their business are going to pay huge dividends[17], too, I’m certain…

“Because they’re both squarely aimed at facilitating the mass scale-up in nuclear power I’m predicting – and that’s already underway, by all appearances.”

That might already be ringing a bell for you, but these are the other clues:

“On top of all this, the firm’s got a robust and thriving nuclear medicine business…

“They’re actually using their own “cyclotrons” and particular accelerators to create cancer-killing compounds for drug companies and hospitals

“Roll it all up and it’s easy to imagine this company tripling or more in value over just the next few years – if not more…

“Heck, they’ve already been up over 26%in just the last three months.”

That one has to be BWX Technologies (BWXT)[18], which we’ve written about a few times over the past year or two — most recently, when Porter Stansberry[19] reiterated his BWXT/nuclear pitch with an Elon Musk[20] twist. I covered that stock in much more detail for that pitch about six weeks ago, and the story hasn’t really changed in the interim (nest earnings report will be November 1), so I won’t repeat myself too exhaustively here, but it’s generally an attractive company with a very defensible niche in government nuclear services, it’s just that their niche hasn’t grown a whole lot recently — here’s how I summed it up at the time:

“It’s a good company, probably near the top end of a reasonable valuation at about 22-25X earnings (they’re likely to grow earnings about 10% a year), but that kind of stability can certainly be worth paying a premium… especially if you have high hopes about that small reactor business becoming meaningful in the next decade or so.”

Next?

“Must-Have Nuke Stock #4: 20x Pioneer of Tomorrow’s Reactors

“Today, we know nuclear power plants as big, imposing structure with huge cooling towers billowing clouds of white-water[21] vapor…

“But more and more, the commercial nuclear-power reactors of the future will be smaller “SMR” type units that look downright futuristic.

“And it’s going to happen sooner rather than later…

“Because earlier this year, the Nuclear Regulatory Commission officially authorized the first iteration of this technology for use in the United States.

“And by all indications, the company I’m talking about will be a key player in the promotion and adoption of SMRs in America.

“They’re on a roll lately, too, snagging both a $263 million contract with the DOE – and another $200 million in capital from Japan[22] and Korean investors, including Samsung.

“They’re also making moves with another U.S. company to adapt their SMR component designs for the Canadian power grid.

“Their shares are trending upward, too – popping as much as 25%in the last two months.

“If I’m right, though, this one’s got TONS of room to run over the long haul…

“That’s why I’m predicting potential gains of up to 2,000% or more by the end of the decade.”

That must be NuScale Power (SMR)[23], which did indeed receive a five year matching award from the DOE for $263 million, back in 2020… and it is the most visible “story stock” in this space, largely because they’re the only ones with a SMR design for their VOYGR power plants certified by US regulators. NuScale is an interesting play because of their design certification, and because they say they’ve got ~120 customers in their potential pipeline to order and build SMRs using their design… but financially, they’re in the very early days. They don’t have any commercial projects underway yet, and they can’t finance projects on their own, which is nice as a business plan, it means they can be “asset light” and provide full lifecycle services for their designed plants and get steady cash flow… but it’s challenging as a startup, because they don’t get to decide how fast to move when building out their initial reactor fleet. If people remain enthused about nuclear and want to build out SMR capacity dramatically over the next decade, they might do great… if the industry hits the pause button, either because of high interest rates or just because their customers are being cautions, they could easily flounder without any real commercial work. They’ve got enough cash to keep up their current pace of R&D and overhead spending for at least another year or so… after that, they’ll probably need more government funding or some larger commercial deals to begin to kick in.

OK, so those are the four nuclear power companies… the other three are uranium plays, here’s how Tilson teases them:

“Must-Have Nuke Stocks #5, #6, #7: Three Reactor Fuel Moonshots

“One day, commercial nuclear reactors might run on things like ultra-common thorium[24]…

“But for the foreseeable future, the name of the game for nuclear fuel is uranium.

“People are starting to realize how important it is, too. Uranium prices are up more than 18% year to date, through July.

“That makes the uranium companies you’ll find in Mining Moonshots: Three Potential 100-Baggers on Exploding Uranium Demand attractive long-term additions to your portfolio.”

Other hints about which of the uranium companies he likes? This is what he includes in the presentation:

“The strategy in buying all three of these stocks is to spread your investment around, in case one or two of them go ballistic for one reason or another…

“And that could easily happen, given what I see coming for the commercial nuclear sub-sector.

“Between the three of these companies, you’ll be getting exposure to:

“At least 190 million pounds of indicated or probable North American uranium reserves

“Both of the existing conventional uranium mills in the United States

“A Canadian mill serving one of the world’s largest uranium mines (14% of global production)

“The largest fully permitted uranium projects of any resource producer

“Many of the best uranium resources in the western hemisphere

“All three of these companies are trending up lately, too – from between 36% and 67% within the last five months.”

That’s enough to get at least pretty close to an answer…

There are two conventional uranium mills in the US, though only one is in operation right now. They’re both in Utah — White Mesa, which is owned by Energy Fuels (EFR.TO, UUUU) and is in operation now, and Ticaboo, owned by Uranium One[25] but currently not operating (it’s been on “care and maintenance” standby, I guess waiting to see if other mines restart in the area as uranium prices rise, for more than 40 years). The two companies who own uranium mills in Canada[26] are Cameco and the French company Orano, but almost all of the uranium production and million in Canada is done by Cameco (CCJ)[27] at its McArthur River mine, the largest single uranium mine in the world. You can’t own part of Uranium One these days, at least not the part that still owns the Ticaboo property, that was sold to Rosatom and remains tied to the good ol’ Russia[28]/Uranium scandal of the Clinton years, though some of the other uranium projects owned by Uranium One have been sold back to a North American company, Uranium Energy Corp (UEC) bought a bunch of their in-situ projects in Wyoming back in 2021.

“Fully permitted” is pretty likely to be a reference to Uranium Energy Corp (UEC), which likes to brag about both its permitted projects and it’s stake in the pre-revenue royalty startup Uranium Royalty (UROY, URC.TO) (which Marin Katusa[29], incidentally, has been paid to tout in promotions recently[30], that’s been filling my inbox over the past week or so).

So that tallies up with three likelies — Cameco (CCJ), by far the biggest pure-play uranium company outside of Kazakhstan, Energy Fuels (UUUU, EFR.TO), owner of the only US conventional uranium mill as well as a producer from other areas, and Uranium Energy Corp (UEC), a portfolio of uranium ISR projects that has been trying to sell itself to investors for more than 15 years.

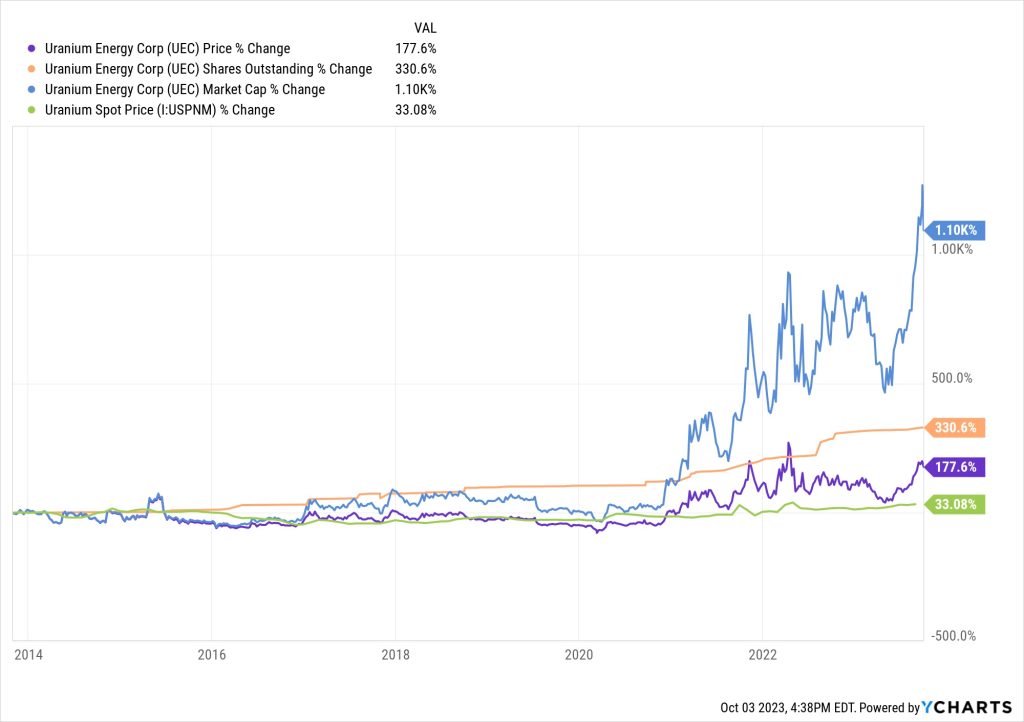

I’ve got a little built-in skepticism about Amir Adnani[31] and his Uranium Energy Corp (UEC), since I wrote about it a few times during a previous frenzy of uranium speculation seven or eight years ago (and even got spuriously sued for doing so, though the case was dropped when the lawyers finally noticed that Stock Gumshoe wasn’t part of the stock promotion scheme they thought UEC was ginning up with Dr. Kent Moors[32]). The thing that really stands out about that company is the fact that they’ve been building up this portfolio of permitted projects for decades, including some that are operational, but over the past decade or so they have issued more shares than they have brought in dollars in revenue… which you can see in the booming market cap and the relatively placid share price. This is the chart of UEC over the past ten years, that green line at the bottom is the uranium spot price, which may or may not be all that reliable (uranium is mostly sold on long-term contracts, the spot market is small), the purple line is the UEC share price, orange is the number of UEC shares, and blue is the market cap.

[33]

[33]

And here’s what that looks like since the Russian invasion of Ukraine[34] back in February of 2022, since that invasion, and the possible cutoff of Kazakh/Russian uranium supplies to the West, has been a key story driver for North American uranium production…

[35]

[35]

And actually, here’s what all three of those uranium names have done since the Russian tanks rolled across the border — uranium spot price in green, with Cameco the biggest beneficiary, in orange (mostly because it never falls quite as much as the little guys), compared to UEC (purple), Energy Fuels (blue) and the S&P 500 (pink):

[36]

[36]

Is it worth trying to pick and choose companies in this space, or might you just prefer to buy an ETF?

Well, the go-to for institutional investors has always been Cameco, since that’s the only company with lots of established reserves and a profitable operating base, and it’s by far the biggest non-Kazakh pure-play uranium miner… but there are a few uranium mining ETFs and one, Van Eck Uranium + Nuclear Energy (NLR)[37], that includes the nuclear service and fuel and power generation companies as well as the miners. Sprott Junior Uranium Miners (URNJ)[38] is brand new this year and could easily disappear if we don’t get a bull market in those junior uranium names, but the other two, Sprott Uranium Miners (URNM)[39] and Global X Uranium (URA) both track pretty well, though their performance is different because they weight differently — URNM has been the better performer of late, so here’s what the chart looks like if you add URNM (brown) and the NLR ETF (dark green):

[40]

[40]

Kind of makes me not want to mess around with the outliers and try to ID the winner, if I’m being honest — I’d probably just buy NLR if I was looking to trade on broad exposure to this space over the next year or so… pretty consistent performance, thanks to those utilities in the portfolio, but clearly also some exposure to uranium that’s letting it ride part of Cameco’s surge so far this year and, at this point, keep up with the rising uranium spot price.

The small companies always provide the wild leverage[41] if you get a bull market (or a commodity bubble), so if you want to maximize your potential exposure to uranium prices maybe going on a tear, it’s usually the really tiny uranium explorers who explode in value, even if they’re almost certainly never going to mine those projects they’ve found, and that’s where a lot of the uranium daydreams are coming, from with almost every teaser in this sector citing Doug Casey[42] and Rick Rule[43] and their bet on penny stock Paladin Energy, which ran from a penny to $10 or so during the mid-2000s uranium surge. But if you want to be more of a conventional player than a swashbuckling prospector type, sometimes you don’t have to do a deep dive into every theme or trend… particularly when it’s a business like mining and utility-like operations, where commodity prices play a huge role and there doesn’t tend to be a lot of extreme distinction in quality among the operators.

So… have you caught the uranium bug? See big riches in buying the little reactor companies, or the big nuclear plant owners, or the uranium miners (or potential miners)? Like this particular group of seven hopefuls as a starting point, or would you prefer just to get ETF exposure if we’re indeed going to see the interest in nuclear power continue to grow… or bet on names that we haven’t mentioned here? Please let us know with a comment below. Thanks for reading!

P.S. As Whitney Tilson notes in his ad, his Energy Supercycle newsletter is now about a year old… so it seems reasonable to start asking how it’s doing so far. If you’ve tried out Energy Supercycle Investor, please click here to visit our Reviews page and share your experience with your fellow investors. Thanks again!

Disclosure: Of the investments mentioned above, I own shares of the Utilities Select SPDR ETF (XLU). I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

- Whitney Tilson: https://www.stockgumshoe.com/tag/whitney-tilson/

- Energy Supercycle Investor: https://www.stockgumshoe.com/tag/energy-supercycle-investor/

- nuclear power: https://www.stockgumshoe.com/tag/nuclear-power/

- uranium: https://www.stockgumshoe.com/tag/uranium/

- natural gas: https://www.stockgumshoe.com/tag/natural-gas/

- coal: https://www.stockgumshoe.com/tag/coal/

- [Image]: https://www.stockgumshoe.com/free-newsletter-subscription/

- Inflation: https://www.stockgumshoe.com/tag/inflation/

- Constellation Energy (CEG): https://www.stockgumshoe.com/tag/constellation-energy-ceg/

- renewable energy: https://www.stockgumshoe.com/tag/renewable-energy/

- utilities: https://www.stockgumshoe.com/tag/utilities/

- solar: https://www.stockgumshoe.com/tag/solar/

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2023/10/XLU-20-year.jpg

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2023/10/CEG-relative.jpg

- acquiring Energy Harbor: https://www.utilitydive.com/news/vistra-energy-harbor-acquisition-nuclear-power/644276/

- NRG Energy (NRG): https://www.stockgumshoe.com/tag/nrg/

- dividends: https://www.stockgumshoe.com/tag/dividends/

- BWX Technologies (BWXT): https://www.stockgumshoe.com/tag/bwxt/

- Porter Stansberry: https://www.stockgumshoe.com/reviews/the-big-secret-on-wall-street-this-week/answers-stansberrys-the-war-on-elon-pitch-secret-energy-grid/

- Elon Musk: https://www.stockgumshoe.com/tag/elon-musk/

- water: https://www.stockgumshoe.com/tag/water/

- Japan: https://www.stockgumshoe.com/tag/japan/

- NuScale Power (SMR): https://www.stockgumshoe.com/tag/smr/

- thorium: https://www.stockgumshoe.com/tag/thorium/

- Uranium One: https://www.stockgumshoe.com/tag/uranium-one-uuu-to-and-sxrzf/

- Canada: https://www.stockgumshoe.com/tag/canada/

- Cameco (CCJ): https://www.stockgumshoe.com/tag/ccj/

- Russia: https://www.stockgumshoe.com/tag/russia/

- Marin Katusa: https://www.stockgumshoe.com/tag/marin-katusa/

- paid to tout in promotions recently: https://katusaresearch.com/uranium-royalty-corp-uroy/

- Amir Adnani: https://www.stockgumshoe.com/tag/amir-adnani/

- Kent Moors: https://www.stockgumshoe.com/tag/kent-moors/

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2023/10/uec-10-year.jpg

- Ukraine: https://www.stockgumshoe.com/tag/ukraine/

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2023/10/uec-18-mo.jpg

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2023/10/uranium-stocks-18mo.jpg

- Van Eck Uranium + Nuclear Energy (NLR): https://www.stockgumshoe.com/tag/nlr/

- Sprott Junior Uranium Miners (URNJ): https://www.stockgumshoe.com/tag/sprott-junior-uranium-miners-urnj/

- Sprott Uranium Miners (URNM): https://www.stockgumshoe.com/tag/urnm/

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2023/10/miners-plus-ETFs.jpg

- leverage: https://www.stockgumshoe.com/tag/leverage/

- Casey: https://www.stockgumshoe.com/tag/casey/

- Rick Rule: https://www.stockgumshoe.com/tag/rick-rule/

Source URL: https://www.stockgumshoe.com/reviews/energy-supercycle-investor/answers-whitney-tilsons-seven-secret-project-e-92-stocks/

9

9