Answers: A New Target for “Imperium” Ads — explaining Adam O’Dell’s pitch about “AI’s Next Great Leap Forward”

by Travis Johnson, Stock Gumshoe | April 11, 2024 3:39 pm

Green Zone Fortunes ad says, "An era-defining technology is set to disrupt the entire AI market in 2024... And one small $10 stock is at the center of it all…"

I covered the “Imperium” ads from Adam O’Dell[1] a couple years ago, when they first started running… that ad, which features a photo of a desktop DNA sequencing machine and calls it an “Imperium Machine”, still looks about the same as it did about three years ago, when the ad started running in the Spring of 2021… and we updated our coverage of that a couple times when it was filling our inboxes in 2021 and 2022, but I haven’t thought about it much since then, and it sort of became part of the wallpaper, easily ignored.

But whaddya know, over the past few months that teaser ad got quietly refreshed… so we’re seeing the ad almost every day again, but it’s now teasing a very different stock.

Which might be for the best… after all, that first “Imperium” pitch was primarily recommending Twist Bioscience (TWST)[2], and had three other “bonus” small-cap recommendations, Aim ImmunoTech (AIM), AquaBounty Technologies (AQB)[3] and (probably) Applied DNA Sciences (APDN), and they’ve all had a tough few years — here’s the chart for those four stocks since we started seeing that initial “Imperium” ad back in late March of 2021 (that’s the S&P 500 in orange, just for some context):

[4]

[4]

Most of us probably bought some stocks back in 2021 at prices we now regret, so I’m sorry if that image brings up some trauma for you.

But today is a new day, and it’s the future that matters, not the past… so what is Adam O’Dell pitching with his “Imperium” story this time?

It’s still an ad for his intro-level newsletter, Green Zone Fortunes[5] ($49 first year, renews at $79), and it’s still all about DNA sequencing, with the “Imperium” just a reference to the latin meaning, to imply that DNA has dominion over everything… and in particular, the ad is about the revolution that cheap sequencing is bringing when it comes to health and agriculture[6], though, no surprise, it also leans a bit on the “AI” angle of the story these days. Here’s a little taste from the pitch:

“An era-defining technology is set to disrupt the entire AI market in 2024…

“And one small $10 stock is at the center of it all…

“… this machine, while simple-looking on the outside, contains a breakthrough technology on the inside … a technology that will be the most transformative in history….

“It’s a technology I call … ‘Imperium.’

“And it’s truly mankind’s next great leap forward…

“Yet one small-cap company … a company that makes machines like these … is at the forefront of it all.

“And today, you have a once-in-a-lifetime chance to invest in this company … starting with a small $10 stake.

“You’ll want to get in right away.

“Because investing in Imperium now could be like investing in internet stocks in the early ‘90s and riding them all the way to their peaks…”

And the growth is coming fast and furious, we’re told:

“… the adoption of Imperium is likely to happen even quicker than adoption of the internet.

“My team and I have determined that while it took the internet nearly 30 years to reach 2 billion users … Imperium technology could achieve this same feat in just three years….

“You can only imagine how high certain Imperium stocks could soar as this breathtaking new technology grows 10X FASTER….

“Unlike the metaverse, blockchain[7], self-driving cars or many of the other tech trends you’ve seen in the mainstream media… “Imperium” is an earlier stage investment where truly life-changing profits can still be made.

“The key is to invest in the right company.

[8]

“And my team and I have found one company at the center of it all.

“If you act quickly, you can get shares for less than $10.”

Other than the pace of growth (three years ago he was saying that DNA sequencing is growing “5X faster” than the early internet, and now he’s saying “10X”), that’s very similar to what he said in his initial ad… though back then he was talking up a “small-cap stock” but didn’t go so far as to put a $10 price tag on it, and he compared it to 5G cellular adoption rather than to the Metaverse… gotta keep those buzzwords up to date!

So… last time around the story was that his favorite DNA stock, Twist, was a “next Intel” idea, because their silicon microchip would be the monopoly provider, as it made DNA sequencing much faster. DNA processing did continue to get faster and cheaper over the next few years, thanks to lots of different technological advances and great economies of scale… but that progress didn’t seem to have very much to do with Twist — they did have good revenue growth over the past three years, but their expenses grew just as fast, and if we think of a monopoly as someone who has pricing power and can demand a profit for their work, well, Twist is a long way from that. And they’re still a tiny player — dominant leaders like Illumina (ILMN)[9] in the sequencing space have suffered, too, in part because of the boom-then-bust nature of spending on COVID testing over the past few years (ILMN shares are down almost as much as TWST shares, actually), but Illumina revenue is still 20X that of Twist.

What’s the stock this time? It’s still about the technology to power “Imperium” machines more cheaply and efficiently, but instead of talking up Twist’s chips, he’s talking up something called “Smart Cell Technology” — here’s how he gets into the details:

“My No. 1 DNA stock is set to be a central player in this fast-emerging mega trend

“Thanks to hardware developed by my No. 1 Imperium company … you don’t have to choose between a partial picture or a blurred image.

“Just about anyone will be able to get all their DNA sequenced … their entire genome … with clear, sharp, pinpoint accurate results….

“It’s able to process a person’s entire DNA genome … and get clear, detailed results … thanks to a new kind of test tray technology that it’s developed and patented.

“I call it ‘smart cell’ technology….

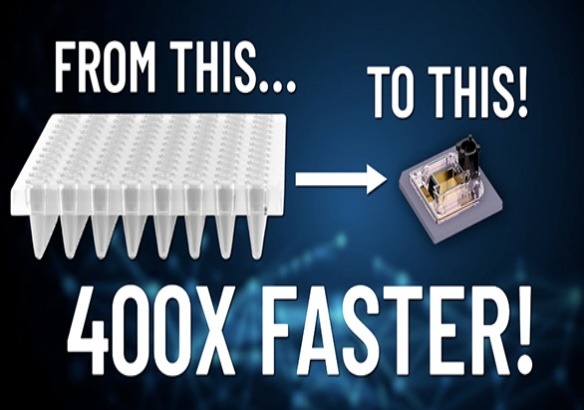

“… by our calculations, this new smart cell technology will allow my No. 1 Imperium company to process DNA at 400 TIMES the speed of the previous technology.”

And he uses this image to illustrate the advance:

[10]

[10]

And he continues to use the “next Intel” terminology, though the metaphor is a little bit more strained now that it’s not a “chip”…

“That’s why I’m so excited about my No. 1 Imperium company … and why I expect it to deliver the biggest gains of my career, by far. Because just like Intel developed a microchip that powered the internet as it went mainstream…

“My No. 1 Imperium company has patented new smart cell technology that is set to power the DNA mega trend as it goes mainstream in the days ahead…

“In fact, Intel jumped into a $100 million funding round to be one of the very first investors in my No. 1 Imperium company.”

And these days, of course, you can’t just tell a technology story… it has to also be an artificial intelligence (AI) story, so that gets slipped in here as well:

“… my No. 1 Imperium company also caught the attention of Google … which has now partnered with it to combine artificial intelligence with DNA sequencing….

“Nvidia sees the writing on the wall too … and it has also joined forces with my No. 1 Imperium company to merge artificial intelligence with DNA sequencing.

“Nvidia’s product leader stated: ‘[My #1 Imperium company] is a prominent leader in long-read genomic sequencing’ — Harry Clifford, NVIIDA Product Leader”

So what’s the stock? Well, I don’t know that the “partnerships” with NVIDIA, Intel or Alphabet/Google are especially huge commitments to this specific company, but there is at least some connection… and the stock O’Dell is teasing is perennial gene sequencing also-ran Pacific Biosciences, often called PacBio (PACB). It looks like O’Dell’s latest variation of this “Imperium” ad started running about six months ago, so you can both criticize me and thank me for not noticing in a more timely fashion that the teaser company was swapped out — we do like to keep on top of new ads that are running, but in this case you’d be pretty mad if you shelled out $10 per share to buy PACB in October or November. The stock last saw $10 in early January, and has now fallen to about $3.50 per share. The image that I shared above, of the “smart cell,” is of the SMRT Cell, a little consumable device[11] that is used to process long-read sequencing in their Revio machine.

Why have things been so ugly for PACB shares? I think it’s probably mostly competition — there are a lot of providers of DNA sequencing machines, and PACB has always had a hard time making a dent in the business, competing with giants like Illumina and Thermo Fisher Scientific (TMO)[12]. PACB’s revenue in 2023 was actually pretty good, and it matched the analyst expectations thanks to 100%+ revenue growth in the fourth quarter, driven by sales of their latest machine (the Revio — they sold 44 more systems in the fourth quarter, bringing the installed base to 173), and a bunch of new partnerships to try to broaden the reach of their machines and increase their sales of test kids and consumables… but the growth was mostly from selling those new Revio instruments, and costs are pretty high for those thanks to the relatively low volume, so the overall finances still don’t look great. The cost of sales and the operating costs both grew faster than revenue, eating into the margins, and the total net loss for the full year was about the same as it had been a year earlier (loss of $1.21 per share in 2023, $1.40 per share in 2022).

Things do seem to be getting better for PACB, they have a larger customer base, but they’re still finding it challenging to compete with the larger DNA sequencing providers — it might just be that there isn’t enough need for the longer-read sequences that PACB focuses on, what they call their “HiFi” capabilities, though they are still trying to build that market, working with lots of researchers to drum up demand. As has been the case for a very long time, they’re growing their revenue at a pretty good clip, their revenue growth has been better than Illumina’s over the past decade, but it hasn’t been enough for them to reach sustainable scale and make a profit, mostly because a high-growth or high-volume market hasn’t emerged for their testing kits. Which makes it seem like maybe this is still a niche product, relative to the big DNA sequencers, but perhaps that will begin to change sometime soon.

Analysts are still somewhat cautious. They’re expecting about 20% revenue growth this year, but think PACB will still be losing $1 per share, and they expect the cash burn to continue for years — right now, the average analyst estimate is that they’ll reach $460 million in revenue in 2026 (more than doubling last year’s $200 million), but that they’ll still have negative margins, losing 50 cents per share. They can afford to work their way to profitability at this point assuming that the cash burn continues to gradually improve, but the ownership of the company is slowly being diluted as a result — they raised $900 million in 2021 by selling convertible notes to Softbank[13], and they still have about $630 million of that left, as of December 31, so they probably have enough cash to get through their next few years, though they also issue new shares pretty regularly, and spend about $70 million/year on stock-based compensation these days, which will probably get much more dilutive now that the share price is so much lower.

There are some folks betting on PacBio, for sure — it’s one of the bigger holdings of Cathie Woods’ Ark ETFs, and Softbank still owns that huge chunk of convertible notes (the terms have been eased and extended once — last year, when the stock was around $12, they exchanged about half of the $900 million in notes that had a conversion price around $40, for notes that go out two more years (to 2030) and have a conversion price of about $20, and it wouldn’t be all that surprising if those get negotiated down further to please SoftBank or extend the terms in some way, now that PACB shares are well below $5).

But these days it’s looking like PACB is in about the same position it was back in 2011, and again in 2016, and then in 2020… they are anticipating that they can scale up to become a self-sustaining company, but they certainly aren’t there yet. They do still have that big slug of cash, so the fall in the share price really seems to indicate that shareholders have given up on their ability to become a viable company. That could be an opportunity, since PACB does still have $600+ million in cash (and a market cap of only $900 million), but that really depends on how the operations of the company go… and whether they can sell enough Revio and other machines, and get more researchers to use their test kits in much greater volume. It’s a hard world out there for small laboratory equipment companies who haven’t been able to scale up their operations, so the path isn’t an easy one, but they are at least still well-capitalized to keep trying.

So maybe PacBio is a bottom-fishing opportunity for you, if you believe in the “HiFi” power of their DNA and RNA sequencing machines, and the likelihood that those machines will become more commonplace in labs around the world. I’ve looked at a bunch of relatively small medical device and lab equipment companies over the years, and “growing up” always seems more difficult than we might expect for these kinds of firms… but sometimes they make it. I can see growing tempted by the low price, if only because they have plenty of cash to survive the next couple years and give themselves a chance, but, as the Irregulars know, I just bought a billion-dollar bio-tools company that I like a lot more, so I’ll pass for now.

Really, the best path forward for PacBio was probably a takeover from one of the bigger players — but the last time they tried that, when Illumina agreed to buy them in 2018 (for $1.2 billion), the deal couldn’t make it through regulatory scrutiny, and was scrapped about 18 months later. Maybe someone else, like Danaher (DHR)[14] or Thermo Fisher, will have a go if the shares keep falling, or maybe regulators would look more kindly on a deal these days, but PacBio management would probably also be less inclined to make a deal at this low price.

That’s just what I think, though, and it’s not my money you have to worry about — it’s yours. Feel like spending some of it to buy PacBio at $3+ a share? Think it’s destined to be a leader, like O’Dell says he believes? Worry that they have too much to prove first? Let us know with a comment below. Thanks for reading!

Disclosure: of the companies mentioned above, I own shares of Alphabet, NVIDIA and Standard BioTools. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

- Dell: https://www.stockgumshoe.com/tag/dell/

- Twist Bioscience (TWST): https://www.stockgumshoe.com/tag/twst/

- AquaBounty Technologies (AQB): https://www.stockgumshoe.com/tag/aqb/

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2024/04/tst-3yr.jpg

- Green Zone Fortunes: https://www.stockgumshoe.com/tag/green-zone-fortunes/

- agriculture: https://www.stockgumshoe.com/tag/agriculture/

- blockchain: https://www.stockgumshoe.com/tag/blockchain/

- [Image]: https://www.stockgumshoe.com/free-newsletter-subscription/

- Illumina (ILMN): https://www.stockgumshoe.com/tag/ilmn/

- [Image]: https://www.stockgumshoe.com/wp-content/uploads/2024/04/imperium.jpg

- SMRT Cell, a little consumable device: https://www.pacb.com/blog/smrt-cell/

- Thermo Fisher Scientific (TMO): https://www.stockgumshoe.com/tag/tmo/

- 900 million in 2021 by selling convertible notes to Softbank: https://www.pacb.com/press_releases/pacific-biosciences-announces-900-million-investment-from-softbank-to-support-growth-initiatives/

- Danaher (DHR): https://www.stockgumshoe.com/tag/dhr/

Source URL: https://www.stockgumshoe.com/reviews/green-zone-fortunes/answers-a-new-target-for-imperium-ads-explaining-adam-odells-pitch-about-ais-next-great-leap-forward/

504

504