Here’s the intro for the Motley Fool teaser pitch that we’re going to solve for you today…

“Something historic just happened here at The Motley Fool

“We’ve identified a stock so exceptional that we’ve now recommended it 9 times… the only stock ever in the Stock Advisor universe to receive that many recommendations.

“Since we first picked it in July 2016, this extraordinary company has delivered an astonishing 1,904% return.”

The fact that your friendly neighborhood Gumshoe is getting a bit long in the tooth gives us a head start on solving teaser pitches –because I probably wrote about this stock when they touted it eight years ago, and I might even be able to remember back that far (I just went to a high school reunion of sorts, and it’s been more than 35 years since I goofed around in those halls, so I’m feeling oooold).

So I’ve already got a guess… but let’s see what other clues they drop…

“… why is NOW the time?

“Because not only has this stock returned close to 20X since we first recommended it 8 years ago… but it’s also trading at a steep 61.5% drop from its peak. Our analysts are calling it a ‘true winner at a discount.'”

This is all about drawing you in to subscribe to their flagship Stock Advisor service, of course ($59 first year, renews at ??), which used to be the place where iconoclastic growth stock picker Dave Gardner and his slightly more value-focused brother Tom made their competing monthly stock picks, as founders of the Motley Fool (which started as an AOL chatroom back in the 90s)… though the brothers seem to have stepped back from those bylines, and the newsletters are now put together by teams of other analysts.

What else do they hint about for this latest re-recommendation?

“… this company is a global leader with a very bright future, handling nearly $950 billion in transactions across 175 countries. We’re talking more online sales than eBay, Target, The Home Depot, and Best Buy… combined….

“The potential for profit is immense, with revenues growing at a compounded annual rate of more than 40% over the past 5 years….

“Our quant projections show potential annual returns of 13% to 15% for shareholders. That’s a heck of a lot better than the 4.5% your high-yield savings is giving you.”

Interesting, I think that’s the first time I’ve ever seen the Fool promote its “quant projections.”

More from the ad about a couple of their past re-recommendations:

“Now in the past, when we’ve re-recommended stocks, they tended to be our highest conviction picks… and some of our biggest winners….

“Netflix received a total of 7 recs. And it wasn’t our first rec that saw the highest returns! In fact, it was a re-recommendation that saw sky-high returns of 36,162%.

“Then there’s Amazon, receiving a total of 5 recs in Stock Advisor, with the initial returns surpassing 24,000%. “

Those were both teaser pitches that I covered at the time… but sadly didn’t buy personally. Motley Fool Stock Advisor does have a pretty exceptional long-term record as a model portfolio, but like most growth-focused investors it is very much the Pareto principle driving those returns — a very small number of exceptional picks, like Netflix and Amazon early on, provide a large percentage of the overall returns. They often have more than 100 recommendations in that newsletter, and they almost never sell to reduce losses or take profits, just letting the cream rise to the top. That’s been very successful over the past 30 years, and it’s not unique to the Motley Fool — many exceptional investors have made most of their money by finding a few fantastic companies and just holding on tight, with their eyes squeezed shut. The caveat is that it’s not always easy for individuals to follow as they read an advisory or skim through a model portfolio — particularly if they pick and choose among the stocks and don’t happen to have bought some of the better performers, or don’t “buy in” to that particular investing philosophy.

But anyway…which stock is it today?

“But this is the first time we’ve ever recommended a stock 9X. That’s unheard of. We truly think investors who don’t buy this stock today will regret it in 5 years time.”

It’s hard for me to believe that they haven’t recommended any stock nine times before — I’ve covered so many teaser pitches of theirs for leaders like The Trade Desk (TTD) and Arista Networks (ANET) that it feels like they’ve been recommended more than 9X in just the past few years… but we’ll take them at their word.

This “9X recommendation” must be Shopify (SHOP), which first came to our attention in June of 2016 when the Canadian version of Motley Fool Stock Advisor teased the company, and then a month later was taken up by David Gardner here in the US as the “little-known stock that took on Amazon, and won”.

And it was certainly an excellent pick at the time, with, as teased, roughly a 2,000% gain if held to today (not quite atop the teaser tracking spreadsheet for 2016, Enphase and NVIDIA were more dramatic winners that were teased that year… but pretty close). Shopify was pretty small back then, with a market cap of about $2-3 billion and a split-adjusted share price of about $3, and it’s now a $90 billion company and trades for almost $70 a share, so it has obviously done well, and they’ve teased and promoted it a few times since… but it hasn’t been an easy ride. (And yes, in case you’re checking off those clues, the $950 billion number is a match, too — though it’s slightly out of date now, and is cumulative… Shopify has handled about $1 trillion in sales, globally, since it was launched in 2006… and that number was $236 billion in Gross Merchandise Volume just for 2023, so it’s changing fast.)

Shopify is primarily an e-commerce software platform and payment processing company — they built what retailers eventually decided was the best platform for creating an online store, and that software offering ballooned into dozens of add-ons and services that they sell to retailers, as well as a very vibrant marketplace for software plug-ins that Shopify users can buy from other developers… and they built in a powerful and easy payments platform for those retailers, which allows Shopify to capture a little more of the economic value as they collect their little slice of credit card network merchant fees.

And the appeal for investors has been that they very much adopted the Jeff Bezos strategy for growth — pour all the cash you generate back into making the platform better for retailers, and expanding on the dominance of your platform to take away reasons why anyone would ever consider signing up with the competitors, who can’t spend as much on R&D or offer as great a product, and worry about stuff like profits later. Sometimes a simple image clarifies that, and this is a slide from their Investor Day presentation that reminds me of those early Jeff Bezos shareholder letters:

That strategy was tailor-made for the pandemic, as Shopify was ready to help the millions of stores who were suddenly forced to adopt an e-commerce strategy, and they grew so fast that they almost couldn’t help but become profitable… but they they also got a little bit out ahead of their skis when they launched their plan to compete with Amazon on fulfillment, building up a warehouse network of their own, which had the potential to come at an extreme cost. Building better software than Amazon is certainly possible, but replicating their global fulfillment infrastructure seemed a bit of a fool’s errand — and when the demand started to slow as the pandemic passed, and investors started looking much more closely at valuations in 2022, SHOP fell hard with all the other COVID darlings.

They have started to come back now, as the company resets for its slower growth rate — like their big-tech brothers, Shopify overhired in 2020 and 2021, (the employee count doubled in two years), and had to go through layoffs, and they also pared back their commitment to their big infrastructure build-out project, partnering that division with Flexport, a shipping and fulfillment startup, so they could take it at least partially off of their own books. That has cleaned up the story a bit, and simplified the business, so where do we stand now?

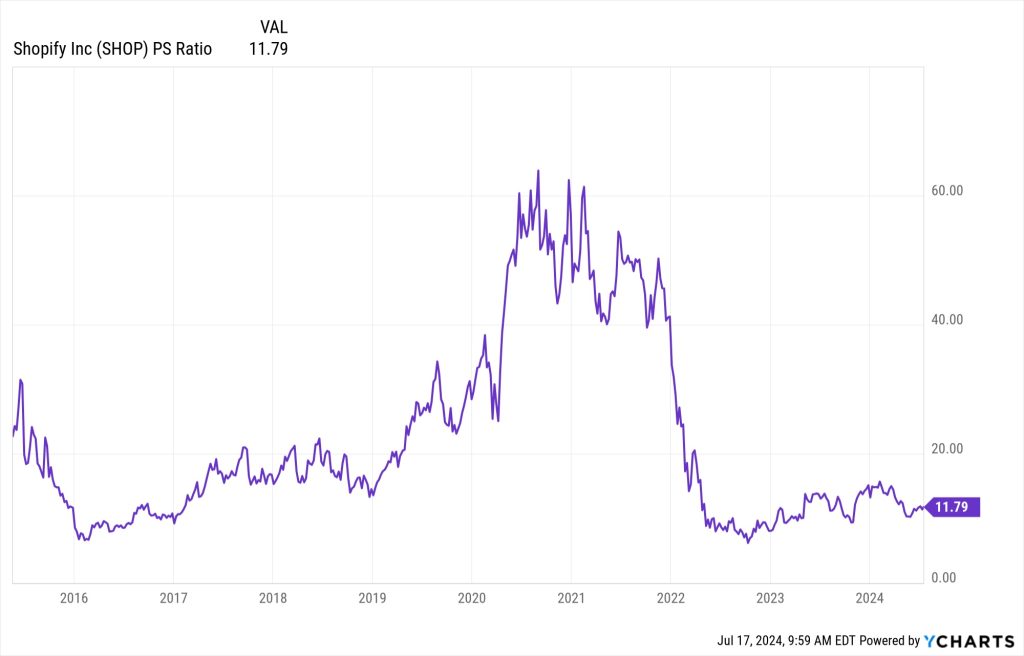

Well, the valuation is generally back to where it was in the early days… they were down around 10X sales back in 2016, and they’ve drifted back down to about 12X sales today, a welcome dose of sobriety after that crazy year or so when they traded at 50-60X sales.

And when it comes to cash flow from operations, which is the metric most folks use to analyze mega-competitor Amazon, Shopify has also9 drifted back down to a much lower valuation, roughly where they were in their early days at about 80X CFO.

But you’ll notice that the numbers I noted above were sales and operating cash flow… not profits. This chart of the past four years helps us remember just how impactful the pandemic was on the e-commerce world, that purple line is revenue per share, which kept growing fantastically and roughly tripled in four years… but the orange line is net income, which exploded higher and then, when the business slowed but the expenses were still very high and growth-focused, collapsed dramatically. So we’re more or less back on some kind of even keel now, where we might have expected to be if COVID hadn’t happened.

So where do we stand today? Shopify is the dominant provider of e-commerce software, they touch about 10% of US e-commerce now, far and away the second-place leader behind Amazon (and yes, they make it easy for Shopify merchants to sell on Amazon’s marketplace, or in Walmart’s, or in tons of others), with strong growth in both gross merchandise volume (the dollar value of sales made using SHOP software) and software subscription revenue. And they have gotten back to being just barely profitable (if you ignore their big writeoff for restructuring the fulfillment business). This is still very much a growth-focused company, and they still have a lot of stock-based compensation — but they’ve also grown big enough that it’s not a massive driver of results at the moment, and the share count has only gone up by about 5% since COVID started.

Analysts currently estimate that Shopify will have 98 cents in adjusted earnings per share in 2024, up from 73 cents last year (GAAP earnings will be up from ten cents to 34 cents, with the Flexport stuff having more of an impact than stock-based compensation on the “adjustments”). The expectation is that the adjusted earnings number will keep growing at 25%+ per year, so $1.26 in 2025 and $1.73 in 2026. That’s not comparable to the 100%+ growth during COVID, which got everyone way too excited, but it’s still exceptional earnings growth. And, sadly, that means we have to pay a pretty exceptional price — SHOP today is trading at about $66, so that’s just a hair over 50X 2025 estimates for adjusted earnings.

I still think SHOP is a great company, and I love it as a consumer (I’m much more likely to buy something if I see that easy “Shop Pay” button), and I’ve owned the stock since 2017, taking some profit off the table a couple times during the manic years, but I haven’t bought any more shares recently. That might just be because my thinking is still anchored in the boom and bust of the past few years, so there’s probably room for more optimism if you really buy into their sector dominance — if you want to learn more about their products and strategy and outlook, I recommend reviewing their Investor Day presentation from back in December.

But for my slightly more sober take, here’s an excerpt of the comment I shared with the Irregulars after Shopify’s last quarter:

“One successful example of that kind of long-term return from this ‘build the best products, and don’t worry about profit right now’ strategy is not enough to convince everyone, of course, and just following the strategy doesn’t mean it will automatically work (there’s only one Amazon, after all), so not many companies can consistently get that kind of leeway from investors… which has led to some rough quarters for Shopify when the numbers don’t look great. And that’s what happened this quarter.

“Shopify has quietly become a profitable company now, even on a real GAAP basis, but just barely — they had ten cents per share in GAAP earnings last year, and are expected to have about 70 cents this year (adjusted earnings were 73 cents per share last year, forecast to be $1.03 this year). Those earnings estimates are dropping a bit for the year, so it continues to be the investors job to guess how much revenue growth will slow (expecting 20% this year, so a LOT slower than the COVID boom years), and what we should pay for this company whose margins are improving nicely as they refocus and get more efficient in their core software-and-payments business, but probably will have adjusted earnings growth in the 30% neighborhood for the next few years. That’s still high growth, and worth a premium valuation — but how much of a premium is the question.

“I really like Shopify’s business, and have held on through some major swings since selling about half of my position in 2019 and 2020, when the stock was dramatically more richly valued than it is today (it was unprofitable and near 30X sales, but growing revenue at 50-70%/year… now it’s just over 10X sales, with growing profits again after the 2021 boom and 2022 bust, and growing revenue at about 25-30%).”

I still think paying something close to 40X forward earnings is pretty attractive for this company, and that the maximum I can justify, knowing that they’re probably still under-earning on that sticky software and payments business a little bit because they’re (still) investing so much in growth, is about 60X earnings. That puts my “max buy” at about $62 now, and “preferred buy” at about $41, and both those numbers are pretty close to where they were when I last looked at the stock a few months ago. There’s obviously a lot of judgement call in there, but I like the direction things are moving at Shopify, I continue to think Tobi Lutke is doing a fantastic job building the company, with ambitions to be much larger, and I’m certainly willing to hold while it plays out, probably for many more years… but I’m also not in a hurry to commit more capital to this position. The shares are likely to continue to be volatile enough to bring buying opportunities along the way — and while the big news always revolves around their fourth quarter expectations, since that’s by far their most important quarter of any year, the stock does tend to bounce around whenever earnings are updated. The next quarterly report from Shopify should come on August 7.

And that’s all I’ve got for you today, dear friends — great company, still a whisker above the price I’d be willing to pay, but also a management team I really like and a company I’m likely to hold for a long time.

Which is all just my thinking, of course, and when it comes to your money it’s your thinking that matters — so feel free to share. Eager to buy Shopify here? Think there are better growth opportunities elsewhere? Let us know with a comment below. Thanks for reading!

Disclosure: Of the companies mentioned above I own shares of Shopify, The Trade Desk, NVIDIA and Amazon. I have trailing stop orders in place for NVIDIA which could hit at any time, but otherwise will not trade in any covered stock (or alter those NVIDIA orders) for at least three days after publication, per Stock Gumshoe’s trading rules.

Renews at $199.

SHOP has indeed been recced 9x in Stock Advisor, TTD 4x, ANET 2x.

I held Shopify for the better part of a year and it mostly just sat in the low 80s the entire time and is even less than that now. As for Mötley Fool, it was the original Stock advisor that I ever joined. They recommended NVDA around $21; and I was in it for many years, then dropped out. They then pursued me so heavily and offered me the introductory rate if I would just come back, that I did. Renewal Was $199. however, I’m no longer in the position that I can keep adding every recommendation they suggest.

If you had bought NVDA you would be in the position! I can’t talk. Heck, I have a post on a MF board back on 2011 where I was singing NVDA’s praises and telling others to buy. Did I? Nope, a mere $1000 investment would have been game changing

But would you have held it without selling any as it went up by ~500% or so twice, then got cut in half twice, before 2023? Stock Advisor first teased the stock in 2014, and I bought my first shares in 2017, but it’s been a devilish ride at times and I’ve traded it badly. Still a fantastic investment, but not as good as it would have been had I just held on and ignored the craziness along the way.

Ditto

Ditto! Made good money on NVDA, but I could’ve retired if I hadn’t sold any share too early…My last sale was at $130, what do you reckon it could be a reentry price? Looking at LT charts it could go as low as $50!

I bought a speculative (small) chunk two years ago when it had largely cratered. I’m up 45%, so I’ll hang on. I think it has a place in the market and will figure out how to manage the swings of the on-line shopping world. That said, it will never be Amazon, because it will never have AWS. Amazon is a cloud service company with a legacy retail business they keep around for nostalgia.

I bought it in May 2000. and sold a bit of it when it hit 500..(that would be 50 these day). Sold another 10% of my remaining shares today. I’ve also bought some real dogs based on MF recs, Lemonade????. They don’t seem to do much due diligence and instead are often going on hype and hope.

LMND…I’m down 90% on that one! Small stake but still hurts. Added some time back at $18, it seems to be able to go above that 1 year consolidation box, let’s see next ER, due on 7/30

(From someone who does NOT understand Crypto and Blockchains)……Can crypto take some of SHOP’s business away from them?

Not unless it really disrupts the payment space, which doesn’t seem to me to have happened in any meaningful way in the past decade. That could theoretically be negative for all they companies who get some of their revenue from payment processing (including V and MA and the banks, as well as smaller folks like SHOP and TOST and SQ and many others), but it’s not a risk that particularly worries me.

Thank you!

I have not subscribed to MF SA in a looooong time, and I remember SHOP being promoted when I did. I too wish I had bought back then. I just picked up a few shares while shorting puts at the last earnings announcement, and I have sold 3 traunches of covered calls. I am not hating this. I am thinking about doubling my position on a day like today where it’s down $6.

Hmmm… very interesting. I’ll be keeping an eye on SHOP for a near future investment, especially if it drifts down to that “preferred buy” number. Your advice 10+ years ago was instrumental with NVDA. Thank you, Travis

Zack’s is recommending Shopify, too. They have added a lot of merchant friendly tools and revenues are expected to be up 18% this quater.

Yep… the problem for the stock is that 18% is about the lowest growth they’ve ever had, and investors would dearly like to see a return to 25% revenue growth. It’s hard to judge the trajectory when a high-growth company is slowing down… or to know what the sustainable growth rate will be when they do “mature”… though it does help that a part of the business is payment processing, which naturally scales.

When Quickbooks desktop POS announced with little warning that they were discontinuing not only point of sale but their integrated payments processing , it rocked the small business bricks-and-mortar retail world. Quickbooks POS was the first widely available computer POS program and hundreds of thousands of businesses had used it for decades, including us. It was a mature piece of software. They handed Shopify their retail business. None of the cloud software companies such as Shopify come close to providing what Quickbooks POS offered but I’m sure that Intuit handing over their former customers gave them one hell of a boost. It’s all about online commerce for Shopify and many other cloud software companies. Integrating data with Quickbooks accounting is now a nightmare. After reading the reviews and Reddit threads about what a nightmare the switch to Shopify was, we selected Lightspeed but it’s also been horrible.

Some intrepid coder should write a simple DESKTOP POS program with or without integrated payments and make themselves a fortune. Cloud software just sucks in a retail situation. They constantly debug on the fly, and tech help is a f-ing chat bot. If you get a human, they’re always halfway around the world.

We’ve actually been so frustrated we’ve considered closing our business and we’re far from the only ones.

I don’t think I want to invest much money, if any, in a company that has negative earnings per share. As in less than one penny in positive earnings. But……that’ s just me.

Certainly lots of folks agree with that sentiment — SHOP did have positive GAAP earnings per share last year, and probably will this year as well… but just barely.

I made a ton on this stock even tho I did none of the due diligence. I sold right before if took a massive drop. I bought again in April 2020 and it did a bounce, but upon learning more on how I should be evaluating for myself I was totally embarassed I purchased so much of a company that had no earnings!!!! Did not stop me from spending my earnings and watching it crater.

FWIW, SHOP was dropped by MF a few weeks ago from their list of Fundamental Stocks. I sold my entire position in that stock as a result.

Interesting — no longer fundamental, but officially re-recommended. What did they swap in for SHOP?

Team Everlasting foundational stocks are ANET, KNSL, NOW, TSLA, and TTD

(ANET, KNSL, and NOW are the newest since 6/27/2024 replacing ABNB, CRWD, SHOP)

Rule Breakers foundational stocks are AMZN, AAPL, NVDA, DIS, VRTX

(VRTX is the newest since 3/28/2024)

Interesting, thanks!

On July 1st the UK arm of Motley Fool Share Advisor service moved SHOP onto its foundational “Starter Stock” list, replacing Britvic (LSE: BVIC). The others are: MasterCard (NYSE: MA); Admiral Group (LSE: ADM); Rightmove (LSE: RMV); Diageo (LSE: DGE) and Domino’s Pizza (LSE: DOM).

I bought SHOP a few years ago with poor timing and got hammered, have bought more since at a better price but still almost 30% under. I’ll just hold on and hope.

My first guess without Reading anything was NVDA which has also gained 119 fold since 2016.

NVDA has gone up a lot more than Shopify — I think the first Fool tease of NVDA (2014) is up about 10,000%, vs roughly 2,000% for SHOP, but I’d have to double check the tracking spreadsheets.

Stocks as expensive as SHOP only perform when the market loves them. This has changed dramatically in Nov ’21 and, since then, SHOP:QQQ never recaptured the weekly MA200 but on the contrary, this MA is now declining since June ’23. A sure sign for me to stay away. I’ll revisit it if it goes back to that strong support area around $40, coinciding with your fundamental analysis 🙂

I have held Shopify previously and it was one of my big stocks during Covid. I did pick up the stock from watching Motley Fool which started the online webinars just when Covid started. I did buy it back on a low at the end of last year but sold it just before the last peak in February. It is a stock I like and I will look to buy it back probably at $25 next May when it should start to show positive performance again.

I’m glad I didn’t add SHOP to my shopping cart. I’ve added NVDA and boy, am I glad!

Of course, hindsight is 20/20. I’m wondering what are 3 stocks that you all consider to be the future NVDAs?

Top on my list is PLTR.

What are yours?

I bought Nvdia and Shopify as the 1st 2 stocks I ever bought other than mutual funds. I t was 2015ish. The other one I bought for next to nothing was SMCI. I bought it based on an article I read in a science journal about uses for their digital twin. ( like I said, lots of luck w no due diligence) In just a couple of years it has gone way up. I would love to hear about some promising small caps. Lly and LMThave been outstanding but they are huge. I too would love to hear some thoughts on small companies w excellent prospects.

Bought SHOP at 69 in maybe 2017ish? Sold at ~1400 near the top. Thought it was too frothy at that point. Got lucky there. PLTR since 2020. Intend to hold it for years. Now DCAing into RKLB. While I dont believe PLTR is speculative because the business fundamentals are solid, RKLB is a bit more speculative. That said, its a growth play and a space play. I expect a lot of volatility. I believe their management is solid, and I like what I can tell about the spending discipline( CEO: “we dont have a lot of money, so we have to be smart” is a consistent phrase I hear he says). I dont buy a ton of single stocks, I tend to research any business heavily before investing, a la the Warren Buffet “you get a punchcard of 20 buys for your whole life” style, so my list is pretty short #SHOP #RKLB #PLTR #BRK-B