An earlier version of this article was published on October 18, 2022, but we’ve gotten a new wave of ads from Nick Hodge, presumably because the gold price has surged and lifted investor interest in little gold stocks, so we’re digging in for an update.

The ad has changed a little bit, but the details are roughly the same… and this current version of the pitch is undated, so that, of course, makes it seem like a “new and imminent” deal, where you have to get in now or miss out, and that has not been the case since Hodge started touting this stock about eight months ago. In fact, the stock is recently down sharply, for reasons that were pretty clear when I first looked at it back in October of last year (the company needs money, and they did a private placement raise more capital… but they did it at a low price, which makes it quite dilutive for existing shareholders, and grouchiness ensued).

But have no fear, we’ll look into this one again, make sure the answers about the stock are still accurate… and we’ll also reveal two “bonus stocks” that Hodge pitches as other ideas for speculation in this latest version of the ad.

Ready to dig in? Let’s go.

Hodge’s ad is for his Hodge Family Office newsletter (“on sale” for $999 for the first year, renews at ?, 60-day refund period), which is his “upgrade” service at Digest Publishing.

And he’s got a looooooong spiel, including some video of his site visit in Idaho and lots of talk about how gold is “rising” (which is not true, not at the moment, so perhaps he put that language together earlier in the year — though the ad is otherwise pretty up to date). But the easiest summary comes from the order form… here’s a little snippet:

“Drilling Into A 20-Bagger: Exposing the Potential of America’s Next Biggest Gold Discovery

“Once details of this historic gold discovery go public… this sub-$1.00 miner will begin a breathtaking ride.

“The kind not seen since Diamond Fields surged for 200,000% gains on its nickel discovery.

“And you have the unprecedented opportunity to buy in ahead of the crowd.

“Remember, I’m only privy to this mine’s real wealth because of my insider contacts…

“And my boots-on-the-ground visit to the mining site in Idaho…

“Few outside of a very well-connected group have even heard of this company.”

What else do we learn about this little gold miner? Well, it’s trading under a dollar… it’s trying to build a mine on the site of a past-producing mine in Idaho (at one time the largest gold mine in Idaho, no less), and he says the project has approval from the locals.

And when he gets into more detail, we learn that the property has about 16,000 acres, and that it might become one of the largest gold mines that’s not owned by the majors (Newmont and Barrick).

He also makes the odd point that he thinks this gold miner has “kept its real wealth a secret” and hasn’t reported all of its gold — he says that they talk about having four million ounces of gold in their project, but that “In reality — and you could only know this by visiting the site — it holds no less than 10 million gold ounces by my calculations.”

The site consists of five different deposits, identified over a span of 3.5 miles and to a depth of 2,000 feet, but Hodge also thinks more gold could be discovered along the strike, or beneath it.

There are also some big-money folks lining up for this project, apparently…

“billion-dollar hedge funds are betting big on this play!

“One made a $10 million bet in early 2022 — enough to own over 8% of the company.”

And much of Hodge’s argument rests on the possibility that once the mine is ready for construction, and they’ve identified more reserves, it could get bought out at a fat premium price… so he compares it to another buyout:

“Earlier this year, large gold miner B2Gold took out Oklo Resources for $62 million. Oklo had gold resources of just 669,000 ounces. So B2Gold paid just over $92 per ounce.

“At that rate, the ten million ounces I think this project has would be worth $926 million, making every share worth $10.65.

“That would make this a 2,030% winner.

“Other takeouts have come at an even higher premium. When Barrick bought out Randgold a few years ago it paid $240 per ounce.

“That would make this ground worth $2.4 billion, and shares of the company that own it worth over $27.50 — some 5,423% higher than they currently trade.”

So what’s the stock? This is, sez the Thinkolator, the junior mining explorer Revival Gold (RGV.V in Toronto, RVLGF OTC in the US), which is trying to develop a mine at the Beartrack-Arnett project, in northern Idaho, a site that was previously mined in the 1990s.

There are two considerations for this mining project, it appears… the near-term potential, which is that they might be able to start with a small mine that can pay for itself, and the long-term potential, which is that the small operating mine they’re trying to plan could help to finance the much larger mine that the big (though as yet unproven) potential deposit could support.

They shifted to this “phase one plan” to talk about a smaller-scale project a couple years ago, basically building a small mine to use the existing infrastructure and produce some of the more accessible ore, generating cash flow that might let them get through to the next phase of possibly building a larger mining operation.

They issued a preliminary economic assessment for this plan back in November of 2020, and it concluded that they could restart the mine with only $100 million in startup capital and then produce 72,000 ounces of gold a year for seven years… and that the net present value of that project, using a $1,550 gold price (we’re at about $2,000 now, up sharply since Hodge first teased it last year), should be $88 million.

That might seem somewhat appealing to investors today, if there’s any potential beyond that small mine, because the current market cap is still under $40 million… but do note that they use a laughably low 5% discount rate to get at that present value. If you used a 15% discount rate, for example, to take into account the risk of a mining project and the much higher inflation and interest rates we have now, the same numbers would probably put the net present value of that project at about $40 million, close to where we are today. (If you’re not familiar with the calculation of net present value, which basically incorporates the cost of money or the opportunity cost for the time you’re waiting for that value to be realized, there’s a good primer on the concept here.)

And we need also to keep in mind that the net present value of the project, whatever it is, won’t be shared among the 87 million shares that existed back in October… that share count had climbed to 92 million by last month, and is going higher now. We noted, in our last update, that they were running out of money, and that creates danger for junior explorers because they have no real option other than to issue shares to raise capital to keep their drills spinning, and if they have to do that at a time when investors are pessimistic, they’ll have to offer any buyers a really enticing deal.

They have attracted funding at good prices in the past, the Donald Smith Value Fund invested $10 million last year to get about 8% of the company, as Hodge teased, and they spent it within a year, but this time, as you can see if you look at the stock chart for the last month, they didn’t get as good a deal — they did a private placement, for units that include a third of a warrant, and still had to cut the price to C$0.52 to try to raise just C$5 million, which was a bit of a slap in the face to folks who were happily holding (or buying) shares at C$0.81 just a month ago. And yes, the stock dropped down to match that fundraising, so it’s under 50 cents today.

It’s a tough tightrope these junior miners have to walk, constantly raising money for the expensive and time-consuming work of exploration and permitting, making the right decisions about drilling and financing and longer-term plans, but also trying to keep their investors excited about projects that always take far, far longer and cost far more than anyone ever anticipated.

It’s really the potential large future mine and the possibility that the deposit has millions of ounces of gold that has Nick Hodge excited — though a bigger project would obviously cost a lot more to build, and probably take a lot longer to get permitted, and they haven’t even gotten to a pre-feasibility study for a smaller project, or booked any measured resources, let alone real reserves. That might change in the reasonably near future, they recently said that they’ve retained a new mining consultant to work on their pre-feasibility study, and that the technical work is underway… but also that it won’t be released until sometime in the middle of 2023 (which could be any day now, frankly, though the latest update still just says “mid-2023”). So for now, it’s just that preliminary economic analysis for the smaller “phase one” project that we have to rely on, plus a raft of press releases reassuring investors that their drilling continues to find high-grade seams of gold, and that the likely conclusions of the anticipated pre-feasibility study are still similar to that preliminary analysis.

What about the comparables that Nick Hodge cites? That takeover of Randgold is not at all comparable — that was an acquisition of a pretty large and operating miner, with cash flow and multiple producing mines and lots of reserves.

But B2Gold’s acquisition of Oklo could be somewhat similar to a potential acquisition of Revival Gold, I suppose — Oklo had a large property in Mali, including a flagship property which had reported its mineral resources just a year earlier (Dandoko) as well as plenty of exploration potential both at that site and at other deposits. Their total mineral resource estimate was 528,000 ounces of measured and indicated gold, and 141,000 ounces of inferred gold, and there was also some synergy because B2Gold has operations nearby, and could use its existing mills for some of the production at Dandoko.

Sadly, however, Oklo didn’t quite get US$62 million — the acquisition was about 2/3 in shares, and B2Gold has lost about a third of its value since the announcement back in May, and it was done in Australian dollars, which have lost considerable value this year… but yes, the consideration ended up being somewhere close to that — I’d say more like $50 million at this point. Which is about $75 per ounce of resources.

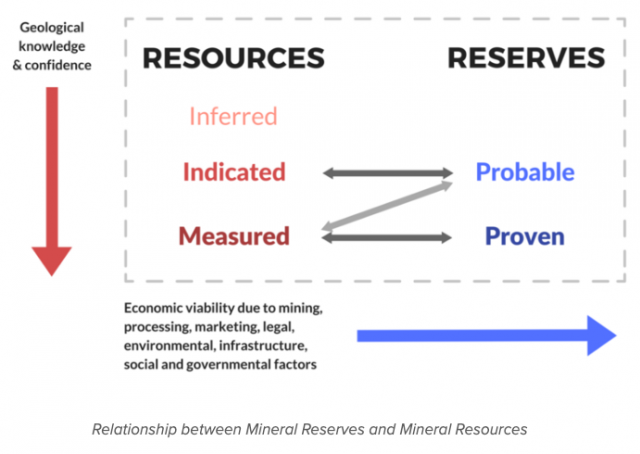

It’s very important to keep in mind that indicated and inferred resources are not at all the same as proven reserves. There’s a continuum of “quality” for minerals in the earth, based on how much drilling and analysis has been done — so an inferred resource is something that you think is probably there in something like a commercially viable quantity, based on initial drilling and some geological understanding of the area. Proven reserves, at the other end, are the result of a lot more drilling to more specifically define what’s underground, with something closer to certainty (though still a ways off — it’s still under ground, after all, and drilling can only show you so much), and proven reserves also come with an economic assessment — not just that the mineral is there, and you’re pretty sure how much is there, but that there’s also reason to believe that you can produce that mineral using defined mining methods and within economic parameters that make real world sense.

It takes time and a lot of drilling and geological analysis work to move from “we found gold” to “I think it’s this much gold” to “we’re really sure there’s at least this much gold” to, finally, “I can promise the bank that we’ll be able to produce this much gold at a profit and repay our construction loans.”

Here’s a useful chart that I lifted from New Pacific Metals that might help the visual learners…

So are those ounces in Idaho, along with the potential of Revival’s remaining property and the likelihood that they’ll find more gold as they continue drilling, worth more per ounce than the Oklo property in Mali? Less? That’s entirely a judgement call, and would include a lot of factors, including location and the exploration potential beyond those initial resource claims, as well as on the acquirer’s inside knowledge about what construction and operating costs might be if the mine ever gets built. But if Revival’s indicated and inferred mineral resource is worth as much to a buyer as Oklo’s measured and indicated and inferred resource, roughly $75/ounce of gold, then that would be about $300 million…. which is, obviously, vastly larger than the current market cap of Revival Gold, which is valued in the stock market (and just sold more shares of itself) at less than $40 million.

Which is how you can fuel some excitement about a junior miner, even if you know that it’s probably many years from even deciding to build a mine, let alone actually getting it permitted and built. IF it works out well, there’s a path to creating a lot of value… but this is mining we’re talking about, so don’t get too far ahead of your skis. If you want to start to dig in on Revival Gold and the project it is trying to develop, their latest investor presentation is here.

The most comparable project in the neighborhood is probably the Stibnite project being developed by Perpetua Resources (PPTA), which used to be called Midas Gold, and which Nick Hodge also pitched pretty aggressively over the past five years or so. Perpetua also sells itself on the notion that it is reviving an old mine in Idaho, will clean up the site of a past mine in the process, and could have a very high grade and large mine once it’s built.

Perpetua’s project is already much larger than the potential size Hodge sees at Revival, the Stibnite project has reported proven and probable mineral reserves of 4.8 million ounces of gold, and another 6.0 million ounces of measured and indicated resources, and they’re involved in back-and-forth with permitting and responding to local feedback about their mine plan right now, so they’re partway through the environmental reviews and the federal and state decisions they need to go in their favor. They still have many years to go, but Revival is years away from even beginning that process. Right now, Perpetua is valued at $114 million, so, for comparison’s sake, that’s about $25 per ounce of reserves, or $10 per ounce of total reserves and resources.

Is one of these projects more likely to be approved than the other? Maybe, I’m certainly no expert on the challenges of dealing with mine permitting in Idaho, and of the different parts of the state, but the two projects seem fairly similar to me… and Perpetua is dramatically further along. Partly thats because Perpetua’s Stibnite project often sat on mothballs for years at a time when gold prices were stagnant, but part of it is just the complexity and cost of exploration drilling and mine planning and federal and state permitting.

Perpetua’s Stibnite project released its pre-feasibility study in 2014, and its feasibility study in 2020 (the feasibility study is the stage where you try to become “bankable,” that’s generally the study the bankers will use to decide whether to finance the mine’s construction), and even the company’s own timeline indicates that they don’t expect final permitting approval for at least another year, with construction perhaps beginning by sometime in 2024, and commercial operations getting underway in 2027. And yes, if you’re thinking about that “have to sell more shares” bit, Perpetua has done a lot of that through the years — since they released their pre-feasibility study, in 2014, their share count has more than quadrupled.

And that’s for a deposit that has a large and economically viable reserve base, with pretty low expected operating costs, and includes a bonus in the form of a big antimony deposit (which also got them a boost in some defense spending this year, to the tune of $24.8 million to help advance the project, which has in turn helped the share price). And Perpetua has a strategic relationship with a huge hedge fund, as John Paulson’s Paulson & Co. have been major lenders to and investors in Perpetua Gold for at least six years (they are by far the largest shareholder now, they own about 40% of the company). PPTA is also valued at less than 20% of the feasibility study’s calculated net present value of the mine, just FYI.

Though it’s also a different kind of narrative, because Perpetua is facing some local opposition but is also a lot closer to maybe making a construction decision, which means it’s “real” — and once something becomes a real potential business, not just an exciting gold discovery, investors often begin to fret more about the financing and the economics of the mine, getting less lusty about the leverage to gold and beginning to think about stuff like cash flow and earnings and construction overruns. One of the major challenges at Perpetua is that they’ve estimated it will cost about a billion dollars to build the Stibnite mine. Raising that kind of money right now sounds very daunting, with interest rates way up and gold prices way down, so sometimes a daydream of a small company doing exploratory drilling on a big discovery is more exciting.

Revival won’t be digging a big pit before 2030, I would guess, so the hard stuff like financing and reserves is way off in the future, it will be years before they even begin to estimate how much the project will cost… but who knows, maybe they’ll move a little faster on their “phase one” project or otherwise get investors enthused (I may be too skeptical, but skepticism is a key survival trait of junior mining investors).

Perhaps Nick Hodge is correct in saying that a smaller deposit is easier to permit and move forward quietly, perhaps Revival’s Beartrack-Arnett project will represent less of an environmental or permitting challenge than Perpetua’s Stibnite project has… but a smaller deposit is also hard to finance. A larger potential mine is sometimes easier to justify to investors and financiers, even if the capital need is greater, so I don’t see any reason why Revival would “downplay” the size of their deposit… particularly because they always need to raise money, and reporting good drill results has often been the way that explorers get their share price up so they can sell more shares. They certainly haven’t been at all shy or secretive about announcing their drilling results, or their larger estimated mineral resource.

Given the very long time it will take to explore this property and move forward with development, even on a smaller scale, I’d guess that speculators are looking for either a rabid bull market in gold, or a takeover by a larger miner… and any longer-term investors, like John Paulson over at Perpetua Resources, who’s pushed for change but still probably hasn’t really made any money on that investment in the past six years, are just betting on the potential leverage of a gold miner, socking away a little exposure to the shiny stuff for a rainy day. Can’t say I blame them, there seem to be plenty of clouds in the sky, but long-term investing in junior mining stocks is tough to justify for most people.

You can get windfall returns from speculating on mining projects, for sure, and plenty of fortunes have been built on the dream of turning hills of rock into bars of gold, but it’s not usually fast or easy, and mining is generally a terrible and expensive business. Permitting is hard, financing is hard, operating mines is hard, even if you avoid the flooding problems or cost overruns or labor challenges that plague many projects, or the political unrest of so many mining jurisdictions (Idaho is pretty easy, relatively speaking, but not every neighbor wants a gold mine to be built… and permitting in the US is very slow), and once you battle your way through that… surprise! You don’t get to decide what the price of gold will be at the time you’re ready to sell it.

The investors who are attracted to small mining discoveries are often the same ones who are attracted to early-stage biotech projects — it’s fascinating stuff, you can quickly learn more than most people about these esoteric properties or projects and make yourself feel like a smart insider, but still, most biotech R&D projects fail at some point on the long timeline to approval and commercial sales… and most mineral discoveries are never mined. You have to either enjoy riding the speculative roller coaster, with a mind to jumping off at some point, or you have to have incredible patience and above-average skill at analyzing these individual projects and separating the winners from the losers. I’m lacking there, and in these sectors I know I’m likely to be buying shares from someone who knows the geology or the biology a lot better than I do… so I don’t tend to invest much in biotech or mining.

And I’ll continue to pass on this one, though there’s certainly a case to be made for optimism in valuing the potential of the property at Revival Gold. If you’d like to make the case or try to talk me into it, or have other junior miners you think are better situated, I’m sure we’d all be delighted to hear your take.

But wait, there’s more!

I told you we’d get to the “bonus speculation” stocks, too — here we go:

“Bonus Speculation #1: Lithium’s Little Giant

“… a tiny company that owns what I think will be the next major North American lithium mine. I expect it to be fully permitted soon ahead of being taken out for a substantial premium.

“An independent study has shown the project is worth $1.9 billion right now. That’s seven times higher than the company that owns it is currently being valued in the market.

“I expect shares will be re-rated to the upside when the permit comes. It already has federal approval and is just waiting for local approval, which is a formality that should happen this year.

“And timing couldn’t be better with lithium prices rapidly advancing as the world races to go electric. Lithium carbonate prices are up some 500% in the past year!

“You’ll have to act fast if you want in on this one. I expect the lowest prices to be had this summer before the mine is approved and built. This is my largest lithium position and I intend to buy more shares.”

I expect those words were written last year, because the company says this project has actually gotten permitting now… it’s just not financed or built yet. Here Hodge is almost certainly pitching Critical Elements (CRE.V, CRECF), whose primary asset is the Rose Project in northern Quebec, a proposed spodumene mine that could supply lithium and which does, per their company’s feasibility study, have a net present value, at an 8% discount rate (NPV8%), of $1.9 billion. It’s pretty far advanced, as these things go, they say they’ll need less than a year for construction, and infrastructure is not a major challenge (they’re right next to a major power line), but, assuming the project goes ahead, it will be a fairly slow buildup — they’d start with a smaller mine, and then aim to both expand it and, if prices justify the investment, build their own lithium hydroxide plant on site so they can move up the value chain and supply battery makers directly. I’ll just repeat what I said when Nick Hodge was pitching this stock in a different ad, for a different newsletter, back in January (the stock today is right around the same price it was then, and there has been incremental progress on the Rose Project, but no big surprises or financing announcements in the last few months):

Will they get that financing? I don’t see why not — the financials look good, it’s got a very short payback period (1.4 years to earn back the capital investment), and a long project life (17 years), with extremely high returns (82% internal rate of return), so the fact that interest rates are probably going to be higher than they expected shouldn’t be a deal-breaker, nor would a relatively minor drop in lithium prices, should that happen… particularly because it’s not a hugely expensive project (they say they need $357 for initial capex, which is the funding they’re presumably looking for today). There could be other problems that I don’t know about, but they say they have good relations with the First Nations in the area, they’re close enough to cheap electricity and mining infrastructure (including roads) to make the project easily feasible, and lithium and tantalum are in high demand. Makes sense to me.

Right now, they say they’re planning to start construction this year, and are currently evaluating potential partners who might participate in the financing, and it’s a shallow open-pit mine so they could be making their final investment decision and beginning production of the first spodumene as early as sometime in 2024. It’s possible, if things continue to go well, that they could also begin construction of a lithium hydroxide plant in a year or two, allowing them to move up the food chain a little and capture higher prices for that battery grade material, but they’re not yet committed to that — right now, they’re focusing on getting the initial spodumene mine financed and built.

I’m no mining expert, I must admit, but the numbers are pretty spectacular — with a 8% discount rate, which is probably too low given the risks and given current inflation, they say the project should be worth $1.9 billion after tax. The stock is currently valued at about $380 million, so that gives a bit of wiggle room — mining development is always risky, but this is a pretty advanced project, close to getting the green light, and that’s a very high rate of return for something that could be just a year or two from becoming “real”. We’re in a period of time when people are a little nervous about speculation… but as speculations go, this doesn’t look like a particularly crazy one.

The big open question, of course, is lithium prices — they peaked in November, and had fallen by more than 60% from that point into April, though they’ve bounced back a little bit in recent weeks. The expected surge in demand from electric vehicles has probably been the most-telegraphed commodity demand curve in history, and production has increased pretty substantially to meet that demand — folks like Elon Musk are telling us we’re still far short of the lithium we’ll need for the EV fleet, and that may well be true, but, well, in the mining world, falling prices have a way of delaying construction decisions. We’ll see what happens with CRE this year.

Critical Elements does have a market cap of about US$350 million right now, so they are trading at a pretty steep discount if the NPV assessment ends up being accurate, so there might be quick gains if someone else buys the project (though it’s hard to imagine anyone paying more than half of that NPV, even with the mine being pretty close to possible production), but, if we’re looking at the skeptical side, assuming they have to go forward with doing this themselves, the financing might be a lot more expensive than they assumed in their feasibility study, and that could further cut into the ultimate value. It’s a relatively attractive proposition, as far as mining projects go, but it’s still a mining project — which means, in my experience, that the surprises are rarely happy ones.

And the other bonus….

“Bonus Speculation #2: A Tier-One PGM-Gold Opportunity

“Its last round of funding was done at a $30 million valuation, while comparable assets currently command market caps north of $1 billion.

“The project was previously owned by a multi-billion-dollar international mining company that drilled it out and established a resource that totals 5.7 million ounces of palladium-platinum-gold and 344 million pounds of nickel.

“Serious speculators will know that a ‘tier one’ project is ‘company making’ mine. They are very large, low cost, and long-lived projects that produce hundreds of thousands of ounces of precious metals per year.

“They are extremely rare to come across. And you’ll have all the info you need on this one ahead of its public listing.

“Its management has serious pedigree. In its Chairman’s last deal, he bought a copper mine for $100,000 and sold it ten years later for ~$400 million, with the stock seeing a 100X increase in market cap after IPO.”

That’s Bravo Mining (BRVO.V, BRVMF), which used to be owned by Vale (VALE), the big Brazilian mining group. It has been touted by Hodge’s colleague Gerardo Del Real in MoneyShow presentations as a “top pick for 2023,” so I’ll just quote from that (you can see his full free article here, it was posted back in January):

“… one of the best undeveloped platinum group elements-gold-nickel projects in the world. One I’ve been waiting on and one that will be worth the wait.

“The project boasts a suite of metals that are all — and will continue to be — in high demand: palladium, platinum, rhodium, nickel, and gold. The Luanga project has a 5.7 million-ounce palladium-platinum-gold historic resource that does not include the rhodium or the nickel.

“Luanga is located in the world-class Carajás Mineral Province, Brazil. Carajas mineral province has a 15.25% effective corporate tax rate. Access and infrastructure are excellent. The project can be accessed via paved highway and unpaved road. Topography is superb, there’s cheap hydropower, water, and labor all readily available.

“However, it’s the people that make me confident this has 10x potential. The company is led by Executive Chairman and founder Luis Mauricio F. Azevedo. Mr. Azevedo is a Brazilian national based in Brazil, fluent in English, and is a lawyer with over 25 years of dealing with the Brazilian mining cycle.

“He also has a history of acquiring assets on very shareholder-friendly terms and then developing, permitting, and monetizing those assets. Mr. Azevedo was formerly the founder and executive director of Avanco, which sold to Oz minerals for A$418 million.”

The stock has climbed about 50% since Del Real presented that idea in January, and it has only been public and independent since last July. This is a potentially large deposit they’re working in Brazil, but it’s also very early days — they’re still doing exploratory drilling, now in Phase 2 of their drilling plan, so there may be stock price moves as they release data about those drilling results, but it’s very early — they are expecting to release a “maiden” resource estimate in the second half of this year, updating the historical discovery and drilling results from 20 years ago, before they move on to more permitting, metallurgical test work, and proving up their reserves to the point that they could consider proposing a mine on the site… and they also say they’ll only move forward when the “commodity cycle is favourable,” which means they’ll be doing some wild guessing at some point, too (if a mine will take several years to build, how on earth do you know what prices will be when it’s ready?)

No idea what the prospects for platinum and palladium and rhodium are over the next decade, I’m afraid, but this looks like a pretty high quality project at an extremely early stage of development. They should have about $25-30 million left from their public offering last summer, and it looks like their capex plus overhead needs are probably something in the $6 million range per quarter, so they should be able to get through to their first mineral resource estimate before they have to raise money again. They ought to be in “raise money and spend it on drilling” mode for a while, I imagine, but if the drilling results are good and commodity prices cooperate that could still work out for speculators.

So… any of that sound enticing to you? Looking for the next palladium, lithium or gold project to bet on? Have better ideas you’d like to share? Do let us know with a comment below… and thanks for reading!

P.S. Does the name Revival Gold sound familiar? It has gotten the attention of newsletters a few times in recent years — Frank Curzio touted it for one of his letters a little voer three years ago, though I didn’t cover that one, and the only time I’ve written about it before was when Nick Hodge’s colleague Gerardo Del Real teased it as a big winner just as COVID was hitting, in March of 2020. The share price is still pretty close to where it was when those prior ads were running, at least in US$ terms — the stock had a little surge with gold prices rising, but gold has come back down and the stock has followed.

On another subject: Does anyone know what companies are involved in the Salt and Sea, CA lithium mining project?

Salton Sea in California. They are privately held companies. Controlled Thermal Resources is one. Berkshire Hathaway Energy is there as well.

I presume you are referring to the Salton Sea projects, which were featured on a recent CBS 60 Minutes episode. They are developing the recovery of lithium with ion-exchange beds (I think) as part of their active geothermal energy generation. The featured company was Energy Source , a private company at the moment. Controlled Thermal Resources and Berkshire Hathaway Resources are also there, but I believe their focus is geothermal.

Very interesting analysis thanks. I think ,as you say, you have to be very wary of getting in to such very early stage Mining companies, unless you can see a time you can get out with a profit. Maybe best to wait until they are closer to actually getting the metal out of the ground. Two companies I think would deserve a mention and to be looked at closely, by Stock Gumshoe perhaps, are Nova Minerals who profess to have nearly 10 million ounces of Gold resource in their Alaska project, a lot of it shallow pit, and for Lithium perhaps Ioneer who have a Lithium project in Nevada and who just increased their resource by 168% and not many have noticed , so in just part of their project they have ,at current prices, around $70,000,000,000 worth of Lithium. Anyway perhaps you might investigate ?.

I’ve already lost enough on junior miners. Still waiting for even one of them to hit pay dirt. I have a special distrust for Canadian companies as well.

Mr “boots on the ground: Hodge is not to be trusted. He gave this same pitch about Midas many years ago and promised big payoffs by 2020 and I bought it hook line and sinker for thousands and I LOST. I do not trust him and neither should you. PPTA is Midas. Repackaged and resold. Fortunately I bought back in recently at $3 and shoud do well but I doubt it will get higher than $10.

I would not buy anything else he recommends with your money nevermind mine.

I have GDXJ_bought it at $30 and GOLD-bought it at $18 That’s enough

Having said that, have you noticed that pretty much every time these so called experets say ” BUY GOLD–now’s the time”—gold drops.? The money goes in and gold goes down. and their money goes out.

Anyway SG thanks for the great job that you do.

RLN

Of these three, my money is on Critical Elements. Good project, great location, experienced and reasonable management (former CEO of Rockwood). They don’t put out a PR every time they find a piece of Spud.

CRECF is down 8% since I bot it in January.

But, just this month, Bull & Bust is recommending Snowline Gold.

SGD Just uplisted to the TSX-V exchange.

OTC is still SNWGF.

Buy up to $3 CAD = $2.20 US

SNWGF is currently at $2.25 US

NOTE: Etrade charges $4.95 to trade this type of stock, so 100 shares would be $230

I have a ton of Perpetua at a loss. I really wish somebody would post some “inside” info on New Found Gold (NFG). I read a lot of good news but when are they going to start producing. Thanks, Andy

Isn’t New Found NFGC?

I see its up a little since I sold it last Sept.

NFG on the Canadian exchange.

Didn’t Mark Twain say a “gold mine is a hole in the ground, with a liar on top”?

There are any number of beaten down juniors that offer higher returns in jurisdictions that seem more development friendly and stable… see what / where Eric Sprott is / has invested and in due time you should do well