Uh, no. Probably not.

Sorry, just had to hit that bit of skepticism up front, before we dig into this one, given the extra-crazy headline. Here’s the full headline that got our attention:

“Forget All the Hype About ChatGPT…

“The ‘Apple of AI’ Is About to Unleash a $15.7 Trillion Tidal Wave of Wealth!

“Here’s How This Tiny $2 Stock Could Turn a Miniscule Stake Into Over $156,750 Starting October 1!”

The old copy editor in me wants to push back on the “miniscule” spelling, but I’ll resist the urge to be cantankerous (minuscule is losing ground to this new variant, I’m afraid). But I’ll keep pushing forward, we won’t be so easily derailed!

So what’s the story this time? Well, it’s an ad from Alex Reid for his Wealthpin Pro newsletter ($49/yr, 90-day refund period). I assume it was timed to be front of mind this week, while Apple is about to release their new iPhone and generate new headlines and remind us all that it’s the most valuable company in the world… so they’re trying to both ride the AI hype, which continues to be pretty strong, and also conjure up daydreams of how rich you’d be if you had bought Apple shares 20 years ago.

Here’s a bit more from the ad, just to get you rolling…

“I’ve uncovered what I believe is the most lucrative AI opportunity on the market right now…

“And it revolves around a tiny company few people even know exist.

“In the coming years however, I predict that:

“This Tiny ‘Apple of AI’ Company Will Power Virtually All of the AI Technology of the Future…

“Meaning You Can Profit From the Entire $15.7 Trillion AI Gold Rush With This One ‘Pick-and-Shovel’ Investment!”

“If this company even achieves a fraction of its potential…

“It will become one of – if not the – most valuable companies in the world.”

He makes this argument because of his secret company’s “AI Operating System” — and he says it will be as central to the next wave of growth as the Apple OS was to the iPhone’s explosive growth.

And, we’re told, this $2 stock is “cheap”…

“But not only is this company trading for just $2 – 3x cheaper than Apple when the iPhone was announced…

“But its new OS goes way beyond smartphones, unlocking the power of AI to transform the largest industries on Earth –

“From the $2.8 trillion auto industry, where it will finally enable the self-driving car revolution that’s been promised to be “just around the corner” for over a decade…

“To the $8.5 trillion healthcare market, where next-gen AI models will all but eliminate disease through the development of hyper-targeted medicines for every person.”

That kind of language permeates just about every hype-filled teaser ad, of course, and it is nonsensical. The trading price of a stock does not determine how “cheap” it is, and for the most part is a meaningless number by itself. Some of the biggest stocks in the world trade for $2 or $3 per share, some, like Berkshire Hathaway, trade for $555,000 per share. Because every company has a different number of shares outstanding, it’s the total market capitalization relative to the “real value” of the company that matters if you’re trying to claim ‘cheap.’

Just FYI, Apple was roughly a $70 billion company when the iPhone was announced in early 2007, and was, of course, quite profitable and successful after years of building the iTunes and iPod world of products and services. At the time, it was trading at a split-adjusted $3 per share or so… but for those who were actually buying or selling Apple shares at the time, before the 7-for-1 split in 2014 and the 4-for-1 split in 2020, the price per share was much higher, something in the $80 neighborhood.

If Apple hadn’t done those two most recent stock splits, the per-share price would currently be approaching $5,000. It was obviously a good buy at the time, or really at almost any time in the past 16 years, given how popular the iPhone turned out to be, but it was not “cheap” on either an absolute price basis or a valuation basis in 2007. The stocck traded at 30-40X earnings at the time, largely because folks were betting on the iPhone creating huge growth following the earlier success of the iPod. And it did, as we now know, amplifying that explosion with the iPad a few years later and the huge growth in their user base and the loyalty of those users… though plenty of folks were skeptical about that first iPhone (including me).

But no, Apple was not a tiny company, nor a cheap stock, when the iPhone was released in 2007. Not in the eyes of the investors of that day.

Sorry, off on another tangent again… let’s get back to the ad. The big “October 1” news is, they say, because of the “shocking” release of their new AI operating system:

“That means by picking up shares in this tiny $2 stock today…

“Before it shocks the world with the release of its AI OS on October 1st…

“You’ll be perfectly positioned to rake in life-changing profits from the defining technology of our time.”

And apparently the stock has already been moving during the AI mania this year…

“its stock is already changing lives, skyrocketing 594% in the last six months.”

So what is this “Apple of AI” company releasing on October 1? Here’s how Reid describes it:

“This Apple of AI has created an operating system that links every app together as part of a distributed intelligence network.

“Within this network, each app can evolve in knowledge and self-optimize, drawing intelligence from the system itself…

“Which means AI developers will never have to start from scratch when creating a new app.

“Instead, each app built on the Apple of AI’s OS starts off smart, saving years of time and millions of dollars.”

So the dream is that once the new operating system is “released” in a few weeks, developers will be beating down the doors to build apps on it, and this “Apple of AI” company will earn some kind of revenue from all that usage.

And he implies that the “smart money” guys are buying into AI investments, too…

“Bill Gates, Jeff Bezos and Tim Cook have poured in billions of dollars each into AI…

“And the most renowned investors on Wall Street are also going all-in:

✔️ Legendary hedge fund manager Bill Ackman has invested over $1 billion…

✔️ Billionaire investor Stanley Druckenmiller recently bet $430 million…

✔️ And shockingly, even Warren Buffett – known to be heavily anti-tech – has poured in a mammoth $166 billion!

“That makes six of the smartest investors in the world that are going all-in on AI…”

That kind of language is repeated throughout the ad, and we should be really clear that those folks are NOT buying whatever tiny $2 stock Reid is pitching… they’re just investing in other companies that are also interested in AI. In those particular cases, they’re all buying the megacaps — Ackman bought into Alphabet earlier this year, Druckenmiller bought Microsoft and NVIDIA, and Buffett, of course, bought a ton of Apple shares seven years ago and has added a bit to that over time, so that’s most of the “$160 billion” he “poured in” (Berkshire Hathaway also owns a bit of some other large companies who are AI-interested, including Snowflake and Amazon, but Apple alone is about half of Berkshire’s stock portfolio, nothing else comes remotely close, and that position was worth $166 billion a couple weeks ago… down to $163 billion currently. And, to be clear, that was not $166 billion that Buffett “poured in,” that’s what it’s worth today — Berkshire’s cost for that Apple position is only about $35 billion).

What other clues do we get about this company? Apparently they have already made some progress with their operating system…

“… even though this company’s AI OS is yet to be released to the public…

“It’s already generated millions of dollars! …

“This company recently did a pilot test…

“Where it created the very first app for its AI OS.

“It’s a navigation app that uses the power of AI to digitize the environment…

“More specifically the inside of warehouses and all the items within…

“Then it shows workers the most optimal route to find what they need via a headset or phone.”

And the claim is that this pilot project was a big success, and they’ve already got some big customers…

“This new AI app been a game-changer for the $9 trillion logistics industry…

“And has been shown to slash the distance workers travel to retrieve 20 items from 2,673 feet to 693 feet….

“… a premier third-party logistics company signed a $26.5 million contract for the app to be deployed in all of its 18 North American Distribution Centers…

“… the largest warehouse management software provider with over 3,500 customers across 78 countries in the world has become this apps first major reseller…”

Along with some hypothetical financials based on that warehouse software reseller…

“With the Apple of AI expecting to rake in $1 million a year from each new customer.

“Given that this $2 company expects a minimum of 350 new customers from this deal…

“That equals a massive $350 million a year in profits…

“From just one AI app.”

The ad also says that they’re developing lots of other apps…

“But this company is developing over 100 additional apps for companies including Fortune 500 firms in the retail, supply chain, and manufacturing spaces…

“Which could mean potentially billions of dollars in revenue for this tiny $2 company…

“And its AI OS hasn’t even been released to the public yet!”

We’ve already got enough clues to give you the answer, particularly because Reid borrowed some images from the company’s own investor presentations to illustrate his pitch, and I happened to recognize those… but let’s finish the story first, he also tells us a little about the company’s management:

“The founder and CEO is a visionary who’s worked at the forefront of AI and other emerging technologies for over two and a half decades…

“… on the board of directors is a world-renowned disruption and innovation expert who has transformed entire industries…

“Like the software technology industry, where he pioneered the shift of media distribution from physical to digital formats…

“Working alongside them is a full-fledged team of AI experts spanning over 60 cities worldwide.”

So who is it? Well, we don’t actually have to pull the Thinkolator out of the garage this time around, we got enough clues for a quick and easy solution: This is Verses AI (VERS on the NEO exchange in Canada, VRSSF on the OTCQX in the US), which was one of the more heavily promoted AI stock ideas earlier this year.

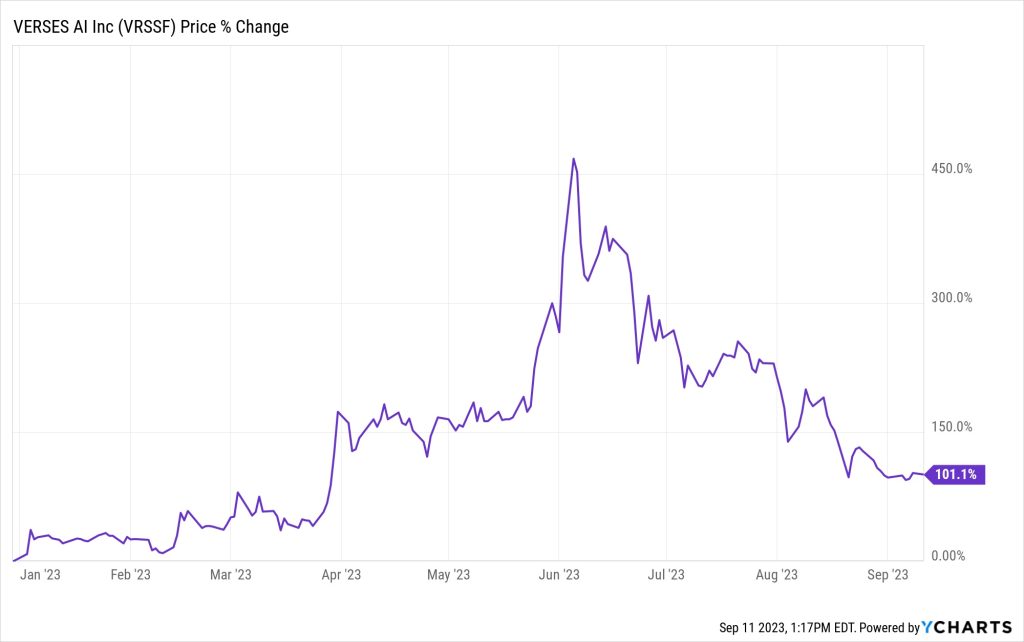

Which means it’s not a $2 stock anymore, in case that was the draw for you — it dropped below a dollar a couple weeks ago. Here’s what AI hype and stock promotion looks like in chart form:

The reason for that drop after the quick surge in late May? Presumably it was their decision to do a capital raise right away, which is what you would expect from a startup that is going to need a lot of cash to try to build its product lineup and acquire customers — that’s why you advertise and promote your stock, like Verses has done, you need to find a way to push up the price so you can raise money at a higher level. They did a private placement of shares and warrants for about C$22 million that closed in July, and have also gotten some cash flowing in as investors exercised some of the prior tranches of warrants during the manic run in the Spring (and, back in March, the sale of some convertible debt… at the same time that they were changing their name from Verses Technologies to Verses AI).

And yes, Verses is planning to roll out its new AI operating system this year, though I don’t know if October 1 will be the exact date (they’re currently soliciting signups to be one of the first testers). That’s KOSM, which they “believe to be the first network operating system for distributed intelligence.” This is how they describe the potential:

“VERSES’ novel approach to AI, inspired by recent breakthroughs in neuroscience, namely Active Inference, is based on encoding knowledge and rules in a format that software agents can process to infer “causality” and the hidden states that generate observed data. In learning about the world, humans develop mental models trained through teaching and educating, whereby the learning process transforms information into a format amenable to modeling the cause-effect relationships that underpin the perceived data or content. Similar to how humans build mental models, the Active Inference framework allows software agents to develop accurate beliefs about cause-effect dynamics and update these beliefs by testing them through interaction and evaluating outcomes. Active Inference entails the missing element of “teaching” or “transforming” raw data into a format that drives the learning of an agent’s mental model. Causal modeling is a form of understanding, reasoning, or thinking that leads to increasingly more accurate predictions, decisions, and the ability to learn and adapt to new tasks and conditions not present in their input data. VERSES’ network operating system, KOSM™, is an implementation of the Active Inference framework.”

Is that genuinely different from the AI work being done by all the big companies in tech right now? Will it gain any traction, whether or not it’s unique or better? Those are big unanswered question for me. I would imagine it will take quite a long time to find out, since they’ll need to get some people testing the new system and trying to figure out whether it’s worth investing their time and resources to build KOSM-based projects.

The actual product that they have in operation right now is their Wayfinder “picking optimization” software, which is designed to help warehouse workers (or perhaps autonomous forklifts) move more efficiently when filling orders.

Verses has been talked up all year as the “next big thing” in AI, but it’s also extremely early days, and it’s mostly funded like a junior mining startup, with lots of inter-related companies run by insiders, tons of private placements and warrants that are accompanied by highly promotional promises about the vast future potential, and an origin story that includes changing the name a couple times to ride a hot trend and going public through a reverse merger and listing on a very accommodating exchange in Canada. That doesn’t mean they’ll fail, but it does mean they’re a long way from becoming a grown up company with any meaningful cash flow. This is how I summed it up when Tobin Smith was touting the stock in June:

Verses AI is a cool story about a company trying to build an operating system for AI, creating an app store-like infrastructure, though they’ve so far completed just a couple pilot projects, mostly in warehouse management, so a lot of the story is riding on products that haven’t yet been publicly released. They’re still essentially pre-revenue, chewing through a lot of cash and likely needing to raise a lot more, and I don’t generally trust highly promotional companies that spend more on investor relations than they take in as revenue, particularly before they’ve got some solid customers and a clear product “hit,” so I won’t get involved with this one. I’ll give them another look if they build the revenue up in the next few quarters and have some real products to discuss. Good story, not enough substance yet for my taste.

That has remained true now that we’ve got another quarter under our belts… still no real revenue, they raised another $7.5 million and used $6.5 million of it, and kept issuing lots of shares, and there’s not much in the way of new customer deals that go beyond pilot projects or tests. They did announce a collaboration with a pharmacy retailer this month, and CEO Gabriel René said that it is “significantly revenue bearing,” but I don’t know what that means.

Here’s where I’m coming from with Verses: It’s a really interesting story as they hope to build a product and have ambitions of creating a new technology platform and ecosystem, and a management team that sounds impressive and is clearly smart and accomplished… but I’m not expert enough in this field to really know if they’re building something with mass market potential, or even if their technology is as unique and exciting as they believe it to be. More importantly, I’ve looked at enough of these types of startups over the past 20 years to be extra-cautious of companies that make bold promises in a hot sector, go public through a reverse takeover, sell a “huge market” venture-capital story to individual investors, list on an easy exchange without much scrutiny, present at LD Micro, and have (relatively) high “investor relations” spending, a cycle that often has to keep repeating as they burn through millions of dollars per quarter while they try to build a revenue-generating business. That doesn’t mean they never win… just that I’ve seen enough of them lose, in dramatic and over-promoted fashion as they face delays or commercial failure but keep selling shares and selling the story to keep the lights on, that my skin has gotten pretty thick, it’s hard for the hype to scratch my greed receptors.

So I’m happy to miss the first part of the potential story here by waiting to see if a real business develops — Verses AI at an $80 million valuation, with lots of warrants outstanding and no real revenue yet, as they burn through cash at a rate of ~C$25 million/year right now, doesn’t interest me… but maybe it will grow up, reach a valuation several times larger with a real business, and I’ll begin to see the risks shrinking and want to get involved, maybe even at a much higher price. I’d rather pay more for less risk or a clearer revenue trajectory with a solid customer base.

Your thinking could well be different… perhaps you’re more willing to speculate on the story than I am, and there’s nothing wrong with that, just know that the stock over the next year or two could easily be at either ten cents and on the way to bankruptcy, if no revenue really begins to kick up and they have to keep selling shares, or at $10 if they sign some big customers to meaningful contracts, or see developers embrace their AI software tools, and investors get excited about the growth potential.

And this story was everywhere during the March and April mania period for AI stocks, so I’m sure many of you have looked at it or thought about it… or even invested in the company. Have an opinion to share? Think I’m being too cautious, or not cautious enough? Let us know with a comment below.

Disclosure: Of the companies mentioned above, I own shares of Berkshire Hathaway, Alphabet and NVIDIA, and of Ackman’s publicly traded Pershing Square Holdings fund. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I agree, there is no rush, but I did grab a few shares at 80¢. At the LD Micro Conference on June 7 the CEO said they had a $300-500 million revenue contract with Blue Yonder which would run for the next 4 years.

That’s the reseller mentioned above, they do have a deal to distribute Verses software. Haven’t seen a specific amount like that disclosed, though, I wonder if it’s a hard number in the contract (a minimum?), or just the Verses estimate of what the demand will be from Blue Yonder’s customers.

The biggest contract I’ve seen disclosed is the NRI one, which is a ten year deal that I think gets them pretty much all of their current sales revenue (10 years, US$26.5M for 18 locations).

Yes, Rene also mentioned the NRI contract at the LD conference, but the Blue Yonder was described as a corporate estimate with the specific number of 4 years. Blue Yonder is now owed by Panosonic. Which makes me woner if theree might be a relationship with them at some point. If the AI is as goos as Vers says, I would think Panosonic would want to own a piece, wouldn’t you agree?

Sure… but there are too many “if’s” in that sentence to get me to want to buy at this point. We’ll see what the future brings.

Travis, I’m with you – let’s keep things “minuscule” for now!

Thinkolator addendum –

I saw a pitch from Oxford Club’s Wealthy Retirement and tried Google Bard.

Primary Ad line: BUY BUY BUY (SIX Buy Ratings), $1/share, energy stock.

I asked Bard to identify stocks with those characteristics. It returned Adams Resources & Energy (NYSE:AE) trading at $1.27/share. Bard also provided 5 other stocks with 6 Buy ratings, but their prices all ranged from $10-$223/share. This was about a week ago.

There was more potentially useful info in the ad, which I did not even give to Bard. I don’t know about the financial potential for this stock and have not invested.

Imteresting to share a new AI tool for Gumshoes.

Where is Adams Resources & Energy (NYSE:AE) trading at $1.27/share?

I see a stock in the 30’s

Yes, Adams Resources and Energy trading on Webull for $35.16!

Most times I am a bit lost in these company deep dives, but AI is one area where I am actually fairly competent. To be clear, the current technology consists of chatbots. not AI. We are a long way from true self learning, self programming intelligent software. Although these bots can be very useful in a wide array of applications, the idea of having an AI operating system is just a joke. Microsoft, Apple and others have been working for years on their variations of the original DOS and Linux and they are far from perfecting them. So sorry, the idea of an AI operating system is total vaporware.

Truth. What they have is Augmented Intelligence, AI is sparking fear when they aren’t even close and panic buying of any company with AI in its name is building up companies with $0 revenue. Get your facts in order before you spend a penny! Watch out for this awareness and Nvidia taking a nosedive. The BIG boys are creating their own specific version of Chat GPT and TSM is making new chips for Elon and his version of Chat.

Albert, when was AE trading at $1.27? I always see it in the $30-$40 range.

$1.27 in his dreams